The ever-evolving landscape of the UK sports betting market is marked by intriguing shifts in user behaviour and brand dynamics. A closer look at the search data reveals a panorama of trends that provide valuable insights into the industry’s current state.

Assuming the US as separate gaming markets, which they indeed are, the UK is currently the largest regulated gaming market in the world, meaning competition for players is significant. One of the most saturated markets, the UK has a plethora of operators seeking player attention, from tier-one giants to legacy brands entering the online space and to new challenger brands such as BetMGM.

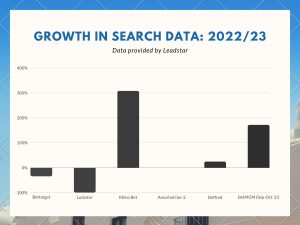

Leadstar Media, an affiliate marketing business with a global presence, has broken down internet search data to paint a picture of who is winning in the lucrative UK market.

The odds comparison portal has revealed that the mature market is still growing and has compartmentalised the data of different groups of operators seeking to engage players onto their platforms.

Leadstar has reported a “surge in search activity”, which it says indicates a market that continues to expand. While it is essential to recognise the limitations of a small sample size, the data provides a broad overview of emerging trends and user behaviour.

Writing for SBC News, Leadstar Media breaks down the data in its latest web search analysis sourced from its Bookiesbonuses.com site.

Brand searches at a glance

We’ve grouped the operators in three different categories based on their search volume to analyse patterns. First, we have “smaller brands” which have a search volume below 100k per month.

Then we have established brands with between 200-500k searches per month and, lastly, the “giants” with searches for their brand name in the millions.

Small Brands

This is the group of brands that have experienced the biggest increase in searches. These brands had a low starting point so a larger uptick in percentage is anticipated. While still growing, these smaller players remain far behind the bigger operators. There are, however, some that have had steep declines as well.

- Bettarget and Luckster: Despite their lower starting points, Bettarget and Luckster have experienced declines of 34% and 99%, respectively. This anomaly raises questions about the challenges faced by certain smaller brands in maintaining momentum even from a modest launch point.

- Rhino Bet: A remarkable 308% increase in search activity positions Rhino Bet as a noteworthy new entrant. The substantial growth is partially attributed to its low initial search volume, underscoring the potential for smaller brands to make significant strides in a competitive market.

It is also worth noting that some of the smaller brands are newcomers to the market, which usually comes with a bonus offer that players can take advantage of. This can be a reason why searches for some of these brands are increasing.

Established Brands

Second-tier brands such as BetVictor, Betway, Virgin Bet, Grosvenor, and Unibet, ranging from 200k to 400k searches per month, have shown substantial growth (ranging from 22% to 49%). While they haven’t yet reached the top-tier brands, their upward trajectory is indicative of their potential to make strides in the market.

Millions in Volume

Market giants such as bet365, SkyBet, Ladbrokes and Coral have maintained stable search volumes in the millions. Betfred, the outlier with a starting point of 1.2 million searches per month, is the exception. Betfred experienced a growth of 25% rather than stagnation, which the other “market giants” experienced.

BetMGM on the move

As a new brand in the UK market, there is no data for the 12 month period. However, BetMGM stands out with an impressive ascent from 40,500 to 110,000 searches between September and October. The brand’s rapid growth, powered by its brand recognition, partnership with LeoVegas and substantial marketing campaigns featuring Chris Rock, positions BetMGM as a formidable contender in the market.

Head Terms and Changing User Behaviour

- Head Terms Decline: Generic head terms like “Betting sites” and “UK betting sites” have seen an 18% YoY decline. This suggests a mature sports betting market where users are becoming more specific in their searches.

- Rise of Long-Tail Keywords: Users are shifting towards more specific searches, such as “betting offers”, “live betting” and “new betting sites”. This shift is also reflected in the increase in branded searches, indicating a move away from generic keywords.

- Online Casino Growth: Contrary to the decline in sports betting head terms, the keyword “online casino” has experienced a 48% YoY increase. This growth prompts questions about the maturity of the online casino market in comparison to its sports betting counterpart. The surge in searches raises intriguing considerations about shifting user preferences and the potential for increased exploration in the online casino space.

The analysis of the UK sports betting search market paints a dynamic picture of growth, challenges and evolving user behaviour. As smaller brands aim for prominence, established giants maintain their positions, and user searches become more refined, the industry faces a future shaped by innovation, competition and changing consumer preferences.