Regulus Partners reviews World Cup 2022 trends, which provides a clear narrative of sports betting’s new and old world markets colliding. Whilst going into extra time, Brazil fails to deliver on its federal sports betting law…

France vs Argentina was hardly an unexpected final to the 2022 FIFA World Cup. However, nearly everything else was different. The time of year and the time of day were both compromises driven by location that had strengths and weaknesses which we believe net off to strengths (see WPs passim). Far more positively for engagement, practically every region in the world was represented, even through to the final sixteen of the tournaments.

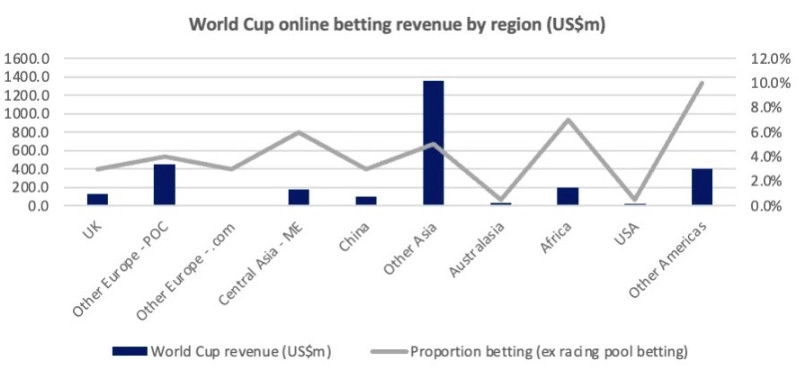

This was reflected in record viewing figures, with FIFA believing more than 1.5bn people watched the final, or c. 20% of the global population; up 34% on 2018. For bookmakers, a record number of goalless draws, the final being a draw and some big teams being knocked out early will have been very positive. We believe that this has led to a c. US$3bn global online betting revenue tournament (NB, this is only a best guess!).

A tournament that involves 31 countries (counting England and Wales as one) from every inhabited continent and which engages at least one person in five can generate very big numbers. However, there are a few obvious caveats to this from a commercial perspective.

First, revenue is not accessible in a global bloc but fragmented across every country whether domestically regulated or not (a very small number of global brands have partially overcome this with product and payments skills, most notably bet365). We believe the UK is still the biggest single betting market by revenue for the World Cup (c. 20m people watched England crash out in the Quarter Finals, or 30% of the population), and we believe c. US$125m would have been added to underlying UK betting revenue. However, this represents only c. 3% of UK annual online betting revenue (although the number of draws could lift margins enough to materially beat this estimate).

The World Cup is a mass market boost for mature markets, but it does not really move the dial in terms of established expenditure patterns without significant margin distortion. Nevertheless, the glut of domestic European football in Q123 as domestic seasons restart is likely to lead to a double product benefit on enhanced engagement.

While of only marginal signfiicance to mature markets, this was an emerging market World Cup par excellence, however, vindicating Sepp Blatter’s long-term engagement strategy regardless of all the attendant corruption. This was not just a battle between LatAm and Europe, the whole world took part: this was the first World Cup in which an African team reached the semi-final stage, with Morocco having the double benefit of representing Arab nations also.

For emerging markets, the World Cup came at the perfect time: typically, not disrupting domestic football so much and after three years of significantly enhanced digital engagement. However, instead of the coercive digital engagement patterns caused policies, the World Cup was an opportunity to choose to be entertained. The 2022 World Cup could not have been better timed or contained better football to achieve this. For emerging markets, we believe that the World Cup is likely to have added a c. 5-10% revenue boost, but a much more sustainable increase in mass market customers. It will now be critical that betting companies ensure that these new customers carefully, focusing on sustainability rather than maximizing revenue in Q123.

An Argentina victory also highlights emerging market dangers, however. Sadly, the Hand of God does not guide Argentina’s politicians. Argentina’s betting market is a convoluted and disjointed fiscal-regulatory mess; its Peronist former Vice President Christina Fernandez de Kirchner was sentenced to six years in prison for corruption during the tournament – FIFA’s governance looks credible by comparison; and, perhaps worst of all an Argentine peso earned in the 2018 World Cup was worth 6.5x more in dollar terms than one earned this year.

Argentina might be a particularly tragic case, but with substantially all mass market online betting growth now coming emerging markets, mining that growth has become far more complex and risky.

Brazil: sports betting regulation is lost on penalties?

Brazil’s Federal sports betting law has technically timed out without Bolsanaro’s Presidential signature. Most informed commentators expect the incoming President, Lula da Silva simply to sign the law in January. From an executive standpoint this seems logical and practical: Lula da Silva does not seem to be against the law and a signature would allow a market that has been in legislative gestation for more than four years finally to get regulated. From a commercial standpoint, getting on with it also makes sense.

We believe that the Brazilian online betting market is now worth over US$1bn (excluding gaming) and this can be grown significantly by a domestically based omnichannel offer. However, our concern is that there remains a critical mass of Brazilian legislators who do not trust gambling and the signing of a technically lapsed law might trigger legislative or judicial opposition. It could be argued that legislators knew what they were doing when they put a ‘time-lock on the betting law and therefore they need to be consulted to ensure that the basis and structure of the law remain valid.

To invite legislative approval is potentially to open a Pandora’s Box (although there does seem to be broad support for the proposed structure); not to do so is to roll the dice on common sense trumping political points-scoring, conviction-based concerns, and respect for due process. Brazil might therefore also offer up some emerging market risks in the near future, in our view.

Featured article edited by SBC from ‘Winning Post’ Sunday 18 December 2022 (click on the below logo to access the full unedited analysis of Winning Post).