Entain Plc has closed its full-year 2023 accounts declaring corporate losses (after tax) totalling £879m as group leadership proceeds with its transformation programme evaluating the firm’s brand portfolio, capital allocation and operating structures

The LSE-listed gambling group announced its FY2023 results this morning, reporting that “results are in line with expectations and leadership is committed to improving operational execution to drive growth.”

On a yearly basis, Entain recorded an 11% increase in net gaming revenues (NGR) to £4.83bn (FY2022: £4.35bn), with the group’s underlying EBITDA maintained at £1bn, marking a growth of 1%.

Highlighted revenues include the BetMGM US joint venture, which achieved a 36% increase in year-on-year NGR to $1.96bn. This performance was at the “upper end of expectations and resulted in a positive EBITDA for the second half of 2023.”

However, a pro forma basis breakdown of segments and markets revealed the headwinds faced by the LSE gambling group during a tumultuous year. Including BetMGM results, online NGR growth was recorded at £3.36bn, a 12% increase from the FY2022 comparatives of £2.99bn.

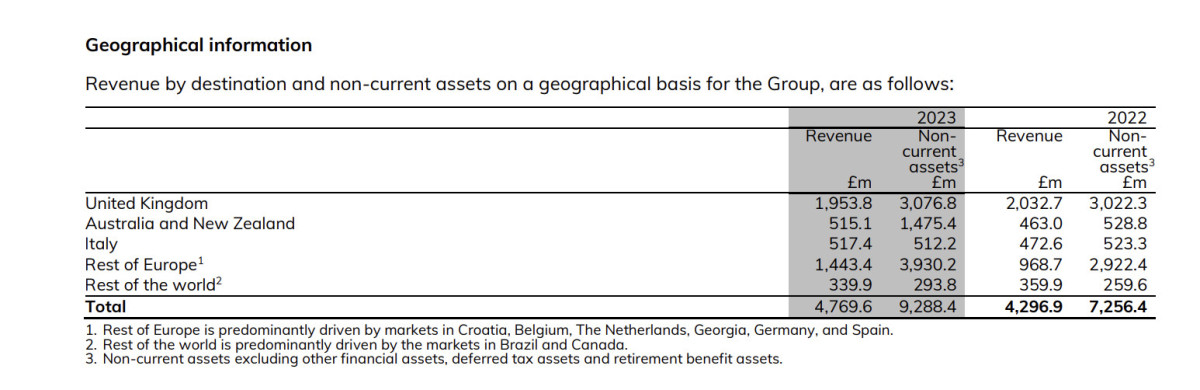

Nevertheless, when US results are excluded, the Online segment saw a 3% decline in pro forma revenues. In its performance overview of online NGR results, Entain disclosed percentage declines in key markets including the UK (-6%), Australia (-6%), Brazil (-14%), and Germany (-26%), with the Netherlands unaccounted for. Entain provided the following geographic breakdown –

As stated: “During 2023, we managed regulatory changes in several of our larger markets, impacting our headline organic performance. The most notable were the implementation of ever-tightening UK affordability measures and the persistent lack of impactful regulatory oversight in Germany. We estimate the aggregate of regulatory impacts was a negative 6 percentage point headwind to Online NGR performance in 2023.”

Despite regulatory challenges, Entain’s online segment maintained an underlying EBITDA of £857m, up by 4% from FY2022’s results of £828m.

However, the accounts noted a flat year-on-year performance when excluding the benefit of TAB NZ accounting treatment for 2023, reflecting the contribution from acquired businesses offset by the decline in pro forma NGR.

The year’s results were bolstered by the improved contribution of Entain’s retail segment, which registered an 8% increase in NGR to £1.38bn, reflecting the “contribution of acquired estates in New Zealand and Poland and the continued strength of the retail portfolio.”

However, the Retail accounts showed increased operating expenditures of £606m, while the segment’s EBITDA contribution remained static at £284m.

As previously disclosed to the market, Entain will record corporate losses in the year’s accounts of £879m, following the decision to settle its UK Deferred Prosecution Agreement (DPA). The settlement saw corporate governance reserve £600m on account to conclude the legal matter.

Chairman Barry Gibson noted: “2023 was a period of necessary, but ultimately positive, transition for Entain. We have significantly strengthened the quality of our revenue base, enhanced our Board, and delivered a resolution to a critical, historic regulatory issue.”

Investors were informed that Entain has established a Capital Allocation Committee, which has “commenced a review of the firm’s markets, brands, and verticals. The review’s objectives are to help focus the organization, improve competitive positions, and maximize shareholder value.”

Despite the ongoing review of its units, corporate leadership endorses the firm’s strategic expansions and acquisitions in Central Eastern Europe and New Zealand, as well as technology enhancements and a focus on regulated markets.

As 2024 trading commences, Entain warns of anticipated regulatory costs in the UK and Netherlands, expected to impact EBITDA by £40m. To address headwinds,, the group will expedite its ‘Project Romer’ initiative to secure £70m in net run rate cost savings by 2025.

Entain Interim CEO, Stella David, reflected on the year, stating: “2023 presented numerous challenges for the Group, both industry-wide and specific to Entain. Despite these challenges, Entain still managed to achieve overall revenue growth of 14%, including our US joint venture, which reached revenue at the top end of expectations.

“We are making commendable progress across various initiatives to refine our market portfolio, prioritize organic growth, increase our share in the US, and broaden our margins.

“With a laser focus on operational excellence and impeccable execution, we are confident that we are charting a course toward sustained growth. Our conviction in our continued, focused execution driving organic growth into 2025 and beyond remains unwavering.”