Renowned gambling investor and industry M&A strategist, Tom Waterhouse, believes that investor appetite will be replenished by the launch of Brazil’s forthcoming federal sports betting marketplace.

A speaker at the SBC Summit Rio, Watherhouse details innovation and effective localisation strategies as key dynamics valued by investors who are keen to see a domestic champions take on foreign giants, as Brazil is set to become global gambling’s next battleground.

______________

SBC: Hi Tom, great to catch-up with you ahead of the SBC Summit Rio…From an investor perspective can you summarise the significance of Brazil launching a federal sports betting marketplace?

Tom Waterhouse (Chief Investment Officer at WaterhouseVC): With a population of 214 million and 217 indigenous languages alongside Portuguese, Brazil will be a vast and dynamic market. Ranking among the world’s largest online sports betting markets, it already attracts 42.5 million unique users as an unregulated market.

The market presents a significant investment opportunity for both operators and suppliers. It will be interesting to see how the market plays out with regards to competition between local and large foreign operators like Flutter, Bet365 and Entain.

SBC: Should stakeholders (foreign and domestic) be happy with the terms of play for Brazil’s sports betting marketplace? (ie, the regime, its laws and restrictions)

TW: In December 2023, the Brazilian Senate passed its betting regulations for sports betting (including in-play sports betting) and online casino. It is a very exciting time for the Brazilian betting market and all key stakeholders stand to benefit, including consumers, operators, suppliers and the Brazilian government.

When examining the consumer, Brazilian regulation includes a ban on bonus offers and a tax on player winnings over US$400, which may push consumers towards unregulated operators. This could reduce revenues for regulated Brazilian operators. Striking a balance in tax regulations would contribute positively to the engagement of these consumers, ensuring a thriving legal online betting environment.

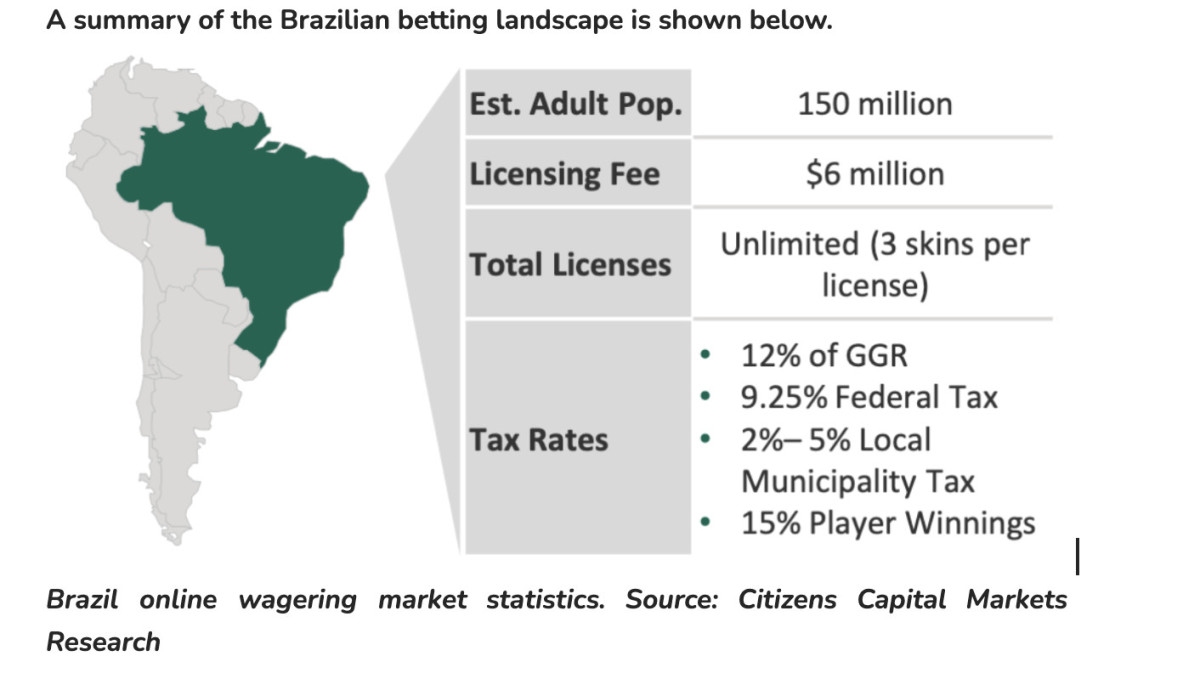

From the government’s perspective, regulating the betting industry should generate a significant new source of revenue through the 12% GGR tax and several other taxes (outlined below). Operators and suppliers in the Brazilian betting industry should be prepared for ongoing regulatory changes as the market continues to evolve.

SBC: The Ministry of Finance has reported over 140 operators, have shown an interest for licences. What does this tell you about the competitive make-up of a yet-to-be launched market?

TW: The Ministry of Finance reporting interest from over 140 operators for licences demonstrates a highly competitive landscape for the industry. It shows that the attractiveness of Brazil’s market dynamics more than offset the upfront $6 million licensing fee. A competitive Brazilian market should lead to innovation, varied offerings, and an enjoyable playable experience as operators strive to differentiate themselves and capture the attention of Brazilian consumers.

SBC: Will Brazil’s market be dominated by international brands, or will we see a ‘local domestic champion’ amongst its incumbents? Is this a point of concern for investors?

TW: It is too early to tell today but the possibility for a local domestic champion to emerge is high considering the complexity and regional differences across different states in Brazil. If a local champion emerges, it is likely to attract the attention of operators like Flutter and Entain, who have a history of buying ‘local heroes’.

Most recently, in September, Flutter acquired an initial 51% stake in MaxBet, the second largest sports wagering and gaming operator in Serbia, for €141 million. Flutter has an option to acquire the remaining 49% of MaxBet in 2029.

SBC: As an investor how will you gauge year-1 initial proceedings of operators competing in the market, what specific competences will you be evaluating?

TW: Similar to assessing operators in other markets, we would assess a Brazilian operator’s:

Market share, total turnover, total gross gaming revenue, historical growth, customer acquisition cost, customer retention rates, customer lifetime value (although it is likely to be too early to tell after just one year), various operating costs, profitability, positioning in the market in relation to competitors (for example, whether the company’s customer acquisition cost is less than other operators), regulatory compliance, technological infrastructure, and dependance on external suppliers.

SBC: Finally, how will Brazil’s market impact the ever-present M&A scenario of the global gambling sector?

TW: The launch of Brazil’s regulated betting market is an exciting growth area for international operators and suppliers. Companies that can demonstrate a Brazilian growth strategy may benefit from increased interest from investors and there is likely to be M&A activity focused on the Brazilian market over the next few years.

For example, international operators like Flutter may acquire leading local Brazilian operators. On the supplier side, affiliates will be able to earn high revenues per depositing customer for the next few years, ultimately increasing their valuations.

_______________________

For groups of 3 or more, you can purchase our Group Pass ticket at the discounted price of R$2500 per person, and gain access to all three days of SBC Summit Rio, including the exhibition, the conference, and exclusive networking parties.

You can keep up-to-date with the latest news, speakers & exhibitor additions and conference content by subscribing to the bi-weekly SBC Summit Rio LinkedIn newsletter.