Omer Liss is the Research Lab Team Leader at Optimove, a customer retention specialist which empowers those active in the gaming industry to exhibit ‘emotional intelligence’ when communicating with their customers.

Omer Liss is the Research Lab Team Leader at Optimove, a customer retention specialist which empowers those active in the gaming industry to exhibit ‘emotional intelligence’ when communicating with their customers.

Having worked with Optimove clients for several years, Liss has concluded that marketing managers who work for multi-product brands can be divided into three personas.

Here, he discusses these three types, as well as the ways that a gaming operator can move forward from one to the other and improve its cross-sell strategy.

The Doubter

One of my gaming operator clients recently surprised me when he asked whether encouraging customers to play in several products is the right move and if it’s needed – “Does it pays off?”

The answer is a straight-forward, 100 times yes – a multi-product customer is worth more than a single product customer.

Proceeding with caution when it comes to money is understandable, but these industry facts may help you move ahead and change your customers’ habits.

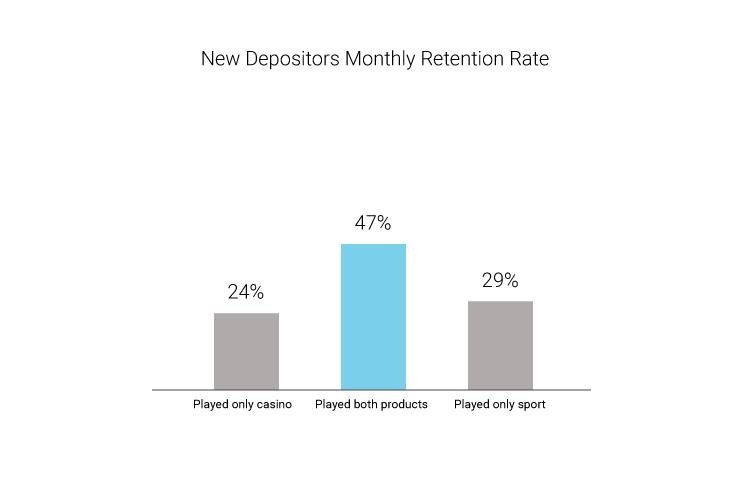

The analysis below presents a benchmark of 10 leading multi-product brands in Europe and their players’ behavior. The first graph emphasises the engagement of multi product customers, who played both products on their first month since their first deposit.

It’s easy to see that customers who played both products (sport and casino) during their first 30 days with the brand, have a higher retention rate than one-product customers. As you probably know, a high percentage from the acquisition pool will fade away just after the first month. An efficient way to prevent their departure is through cross-selling.

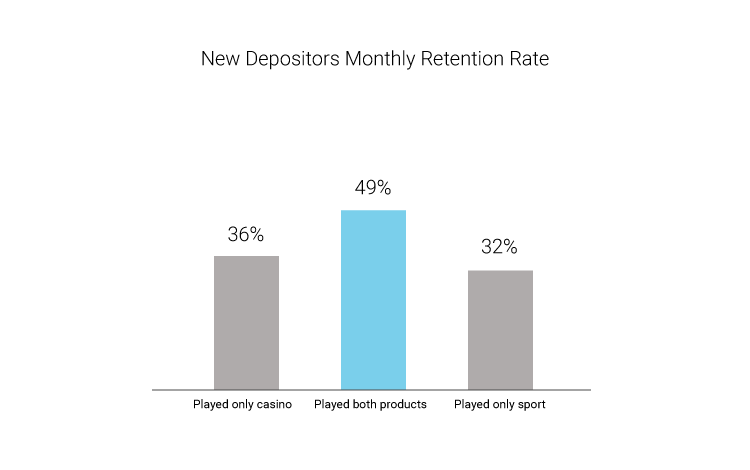

I made another analysis for players who had at least two bet days. For the fairness of the analysis, I made sure that all players (in all 3 bins) had the same chances to play in both products (Simpson’s paradox-the retention rate for only one product may be due to the fact they played just once). Below you can find the repaired results for players with more than one bet day.

While the retention rates increase (as expected, we are excluding weaker customers with only one bet day from the chart), we still see a high difference between multi to one-product customers.

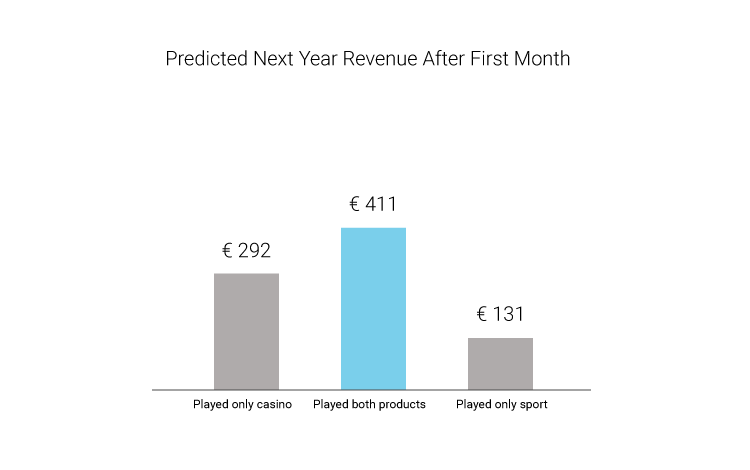

What else may help make up your mind? Below you can find the predictive revenue from each group of players after their first month activity.

As presented in the graph, the expected revenue from multi-product customers is more than double compared to new players with wagers in only one product. Are you ready to move onto the second phase?

The Believers: Preaching to the Choir

Most of today’s gaming companies understand the importance of cross-selling. The problem is that the ‘how’ – is much more of an issue than the ‘why’. How should you convert a one-product customer to a multi-player? What can you, as a brand, do to influence customer behavior? And when do you put your plan into action and loop the customer in?

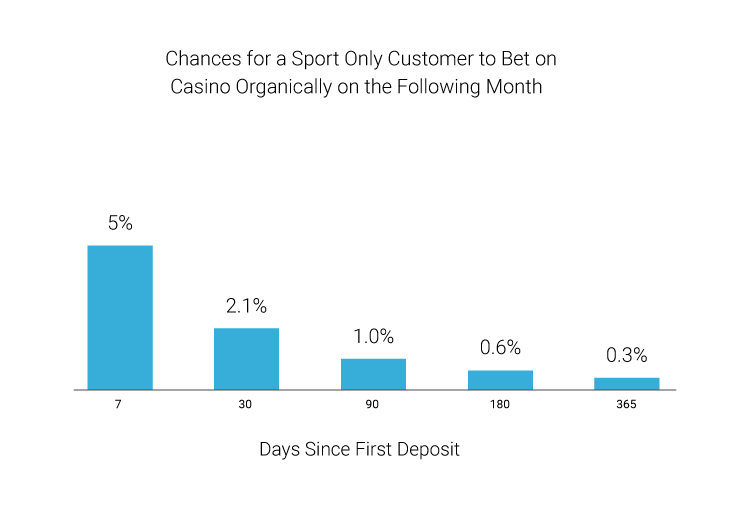

Quite simply, the sooner the better. Below, are the chances a new one-product customer can organically place a bet on another product in the next 30 days.

The analysis shows that as time goes on, the opportunities to bet on the second product decreases. For example, a seven-day-old customer (since his first deposit) who played only sport, has a 5% chance to place an organic bet on casino in the next 30 days without any external assistance from us. After three months without any casino activity, it drops down to 1%.

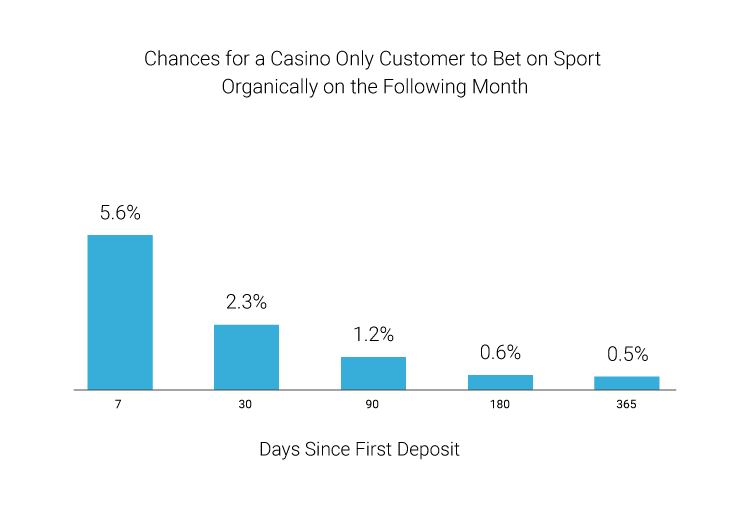

The same situation occurs in the other direction – the chances of casino-only-customers to place a sport bet are as follows:

Obviously, the chances of each group may change dramatically based on your brand orientation, but the trend is clear. As time goes by, the chances of a one-product customer to place a bet on a different product decrease. So, what are we waiting for?

Many of my clients are targeting their players with cross-sell campaigns during the early stages. Most of these campaigns show great response rates by the players, enabling the operators to affect customers’ behavior and encourage players to play in new products. From my personal experience, it’s much harder to reach that level during a later stage, when customers have already settled their habits.

The Difference Maker: Act on the Results

After understanding the importance of cross-selling, its many opportunities, and after creating campaigns to introduce your products to your one-product customers, you need to understand how to read the numbers.

The main problem with cross-sell campaigns is the time we should take to evaluate them. For example, let’s take a familiar and common campaign from the gaming industry – the ‘Second deposit offer’. In this campaign, our main goal is to encourage one-time depositors to place their second deposit by making them an offer.

Once the offer is sent, you’ll be able to measure the response in number of customers who placed their second deposit comparing them to a control group. One to three days is usually enough to evaluate the campaign’s performance.

As described earlier, your cross campaigns should have a different objective by default – we do not try to encourage customers to make a single action, but to change their behavior on a deeper level. One bet day on a new product won’t be enough, mainly because most of these campaigns are accompanied by a free bonus. The final winning result would be a multi-player who continues on in both products.

The way to analyze these kinds of campaigns is to observe them in a long-term duration framework. Instead of analysing these campaigns one to three days after they were sent, exclude these days and calculate the response after several weeks. Seems complicated? Don’t give up, keep on reading.

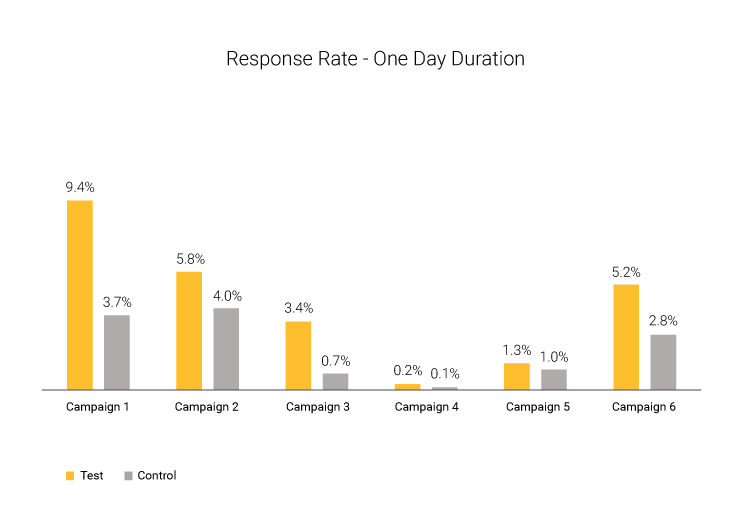

For the analysis below, I used six multi-product brands who created cross-sell campaigns. In these campaigns, casino promotions were sent to the customers. Some even included free money offers with the gentle nudge to “just try it – it’s free”.

Depending on the sites’ orientation, the timing and the offering, the response rate will vary between brands. Nevertheless, all the campaigns were statistically significant on their first day in terms of casino bets. This results in the hypothesis that when someone gives you something for free – you’ll take it. Thank god our players are humans.

On average, the test group (customers who received a cross-sell campaign) had more than a 140% increase compared to the control group (customers with the same behavioral DNA who didn’t receive the campaign). From a ‘Second deposit campaign’ perspective – the campaigns worked great. More customers took our offers and played on a new product. Was that our main objective, though?

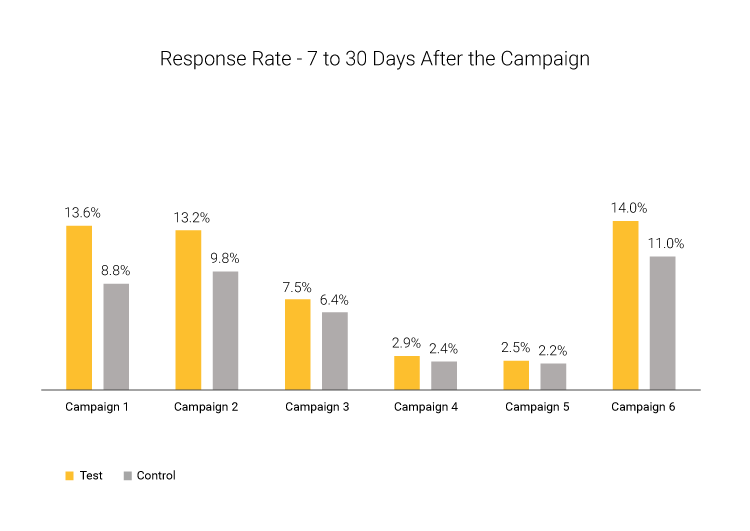

To further analyse the situation, I excluded the first seven days following the offers to erase the immediate effect of the bonus. The analysis duration was between 7 to 30 days after the campaigns were sent – to observe the customers’ behavior without any external attractions. The chart below shows the campaign’s final results:

The response may seem higher than before (it is), mainly because instead of presenting the opportunity to perform an activity on one day, we are examining a period of 23 days – way more time for the customers to play with a new product. Most importantly, is the higher response of the test groups.

Although we illuminated the bonus affect, more customers are playing in second product – now organically. To summarize this analysis, five out of six campaigns were statistically significant, and the aggregation showed an important result – an increase of 20%. The campaigns were able to increase the number of customers who will play in a second product tremendously.

It is crucial for operators to understand the value of cross-selling and the way they should create successful campaigns which will impact their customers’ overall activity. A clever and intelligent analysis will provide you the insight whether you were able to actually perform a substantial change in your customers’ behavior and habits.