All betting industry eyes have been firmly fixated on Latin America, a region which Rush Street Interactive’s (RSI) Emilia Perez believes could pose an even bigger opportunity than the company’s founding market of the US.

Due to appear at the SBC Summit Latinoamerica in two weeks time to discuss marketing strategies on an expert panel, RSI’s Marketing Director LatAm gave SBC Media an exclusive look into the principles of the operator’s strategy for this high-value region.

SBC: What comparisons can you draw between North and South American betting markets when it comes to implementing a marketing strategy?

Emillia Perez: As a curious fact about the North American betting market, according to Statista, the number of users is expected to amount to 105.3 million users by 2027. Also, in global comparison, most revenue will be generated in the United States (US$19,140m in 2023).

Seems huge, but you’ll see later why LatAm can be even more interesting! In the US there are state-by-state regulations, and some can restrict certain types of wagering activities. This is important because it has a big impact on marketing, because promotions, communication, responsible gaming, and other topics can be affected by what the regulation in each state is requesting.

In Latin America, there is a similar situation where the gambling market clearly reflects the diversity of the region with the different legislation to regulate operations, however, there are some variables that make LatAm a very interesting opportunity for foreign and local gambling companies.

First, the passion for sports and especially for soccer, we’re crazy about soccer in Latin America! There is also an increasing mobile phone ownership, a bigger internet connectivity, and a more flexible online gambling regulatory framework. According to Statista, Latin America’s online gambling market will grow exponentially to $3.4bn in 2025. We have become the place where companies from the entire world want to be!

In terms of marketing strategies, apart from the legislation, there are some key factors to consider when entering new markets: preferred language and slang, users’ preferences (sports and games), and cultural background. For example, while in the US and Mexico, American sports (football, baseball, basketball) are very popular, in most countries in Latin America, soccer is the biggest. Same with casino games, popular games in North America don’t necessarily are the same in LatAm. This is why elaborating research and understanding the diversity of the countries is key to make strategic decisions before entering a new market.

SBC: Would you say a North American marketing approach can be altered to fit the dynamics of Latin America or do operators need to start from scratch?

EP: A North American marketing approach can serve as a base or start point; however, the success of the communication will depend on how you adapt it to each market where the operation will be. A driver that’s important for a potential gambler in the US can be very different to a driver that’s important for someone in Colombia or Ecuador. A successful phrase or slogan in English can sound very different if you just translate it to Spanish, slang is important!

And this is not only happening between the US and LatAm in general, but this also can also happen in the different countries from the same region. What works in Peru does not necessarily work in Brazil. Interests are also different, while RSI in the US is very strong in casino and marketing is focused on this product, in Colombia what’s important are sports, so everything changes between markets and a good marketing strategy should be flexible enough to adapt to these differences. In Colombia we say: Communication needs to be tropicalised!

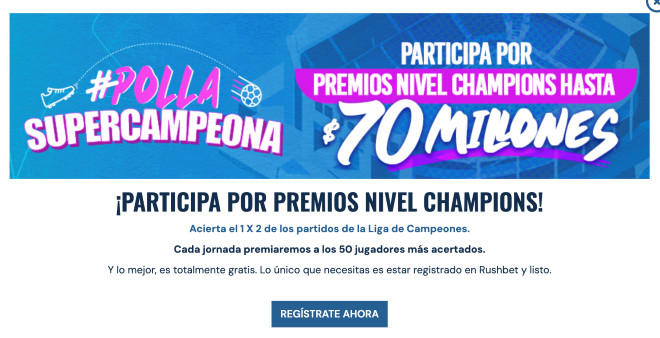

This is an example of how the same promotion can be used in two different markets considering sports preferences, interests, and slang:

SBC: Can you give us a breakdown of Rush Street Interactive’s own LatAm marketing approach? How do you set yourself out from the competition in the region?

EP: In RSI LatAm we focus on three important variables: coherence, consistency, and differentiation. Coherence because we want to be where it is relevant for us to be, consistency because the quality of our communication must be the same in everything we do, and different because we want to stand out and make our brand easy to remember.

To achieve this, we have strong messages to deliver our value proposal for each product: trust in statistics (sports), and more ways to win! (casino). Yes, when everybody is talking about having fun and being passionate, we are inviting our players to use their brains before placing a bet, and of course, giving them tools to do so. Betting with intelligence is also aligned with responsible gaming regulations, and this is simply a projection of the values of our brand.

Here are some examples of how we help our players to do smart bets:

SBC: What emphasis have you placed on localised marketing across your active markets of Mexico and Colombia?

EP: Localised marketing is exactly what we do in RSI, and a clear example is the communication we have for Colombia and for Mexico. As a quick context for those who are not familiar with the concept, localisation is the process of adapting the brand to a specific context. In our case, the product origin is North America, but we have created a specific brand for Latin America, so we have a foreign source and platform, with a localised marketing strategy.

The objective when using localised marketing will always be to make the audience feel the brand was created especially for them! Speaking to them in a language they understand and addressing their needs and pain points will never fail. Some basic steps to prioritise localised marketing are translating the content materials into native languages of local markets, don’t forget about slang! Also, changing the characters to fit how the nationals look if needed.

As an example, you can see in the following images how a message was adapted to fit the Mexican culture and slang, vs a message that was created for Colombia, where we use a local brand ambassador, Abel Aguilar (former Colombian soccer player).

SBC: Responsibility requirements across Latin America can vary from country to country, how does RSI ensure its marketing promotes a coherent brand image across the region whilst meeting different compliance metrics?

EP: For RSI, gambling is a form of entertainment that shouldn’t negatively impact a player’s life, and that’s why we have developed different strategies to achieve brand responsibility. Being aware of responsible gaming starts in our own house, so every year all employees must certificate in responsible gaming awareness and understanding how it works with different tools to know how to act in every moment of their jobs and with our players. Yes, we have our own e-learning platform!

All our company processes and promotions are aligned with both countries gambling operators, SEGOB and Coljuegos, for Mexico and Colombia respectively. Additionally, we have intentional campaigns to communicate responsible gaming as part of our regular content. Being a very conscious brand about responsible gaming makes our principal sport communication based on betting in an intelligent way believing in statistics as the main tool to make all decisions.

How does this commitment live in different touchpoints with our player?

- Special shows on TV where statistics are discussed to help players make better decisions: Betcenter (ESPN).

- Stats centre in our platform.

- Specific content focus in intelligent bets: Game intelligence podcast, Game Time streaming show.

- Influencers and brand ambassadors creating content with stats as a principal asset to bet.

SBC: From a leadership perspective, what are the fundamental market conditions that must be considered for market launch in South America?

The most important thing before entering a new market in Latin America is knowing the market first. Assuming that knowing the category you are in is enough actually isn’t! So, I highly recommend you run some studies and do research before making strategic decisions.

After having a clear background, I believe there are some market conditions to consider:

- Timing: Is it the best moment to go to that market?

- Compliance: Is the market regulated? How does the legislation status affect the operation and marketing actions?

- Market size: Is there space for my product? What are the real goals we can set once we enter the new market?

- Market growth: Is there a big opportunity in this new market? Will the effort and resources be well allocated?

- Colombia: According to Coljuegos, in 2022, 26 billion pesos were reported because of the online betting industry, with a growth of 67% compared to the previous year.

- Peru: According to a study carried out by the consulting firm Attach, in 2019, two million Peruvians participated in sports betting, a figure that rose to five million in 2020 during the pandemic. By 2021 this figure increased by 20%, registering six million Peruvians participating in sports betting.

- Brazil: According to Yogonet, The Brazilian betting market recorded operations for R$7m in 2020 (USD 1,325.5m), and it is estimated that in 2023, it will reach R$12m (USD 2,272.2m).

- Mexico: Yogonet says that the Association of Permit Holders, Operators and Suppliers of the Entertainment and Gambling Industry (AIEJA) assures that the Mexican market is in a position to compete internationally, and they hope that the evolution will continue in the coming years with a 100% growth in regarding online casinos and 30% regarding physical casinos.

- Marketing approach: Is your communication ready for this new market? Did you already localise it? (Ex. slang, visuals, interests of the audience, etc.)

- Consumer pain points: Are you ready to address your audience’s pain points?

- Competitors: Do you deeply know your competitors? Is your product ready to compete?

- Value proposal: Is your value proposal what the potential users are expecting? (Ex. welcome bonuses)

The more conditions you analyse and consider, the more you will be creative enough to be successful!

Taking place between 31 October-2 November at the Seminole Hard Rock Hotel and Casino in Miami, SBC Summit Latinoamerica features a plethora of high-profile speakers as well as networking opportunities. To check out the agenda and book tickets, click HERE.