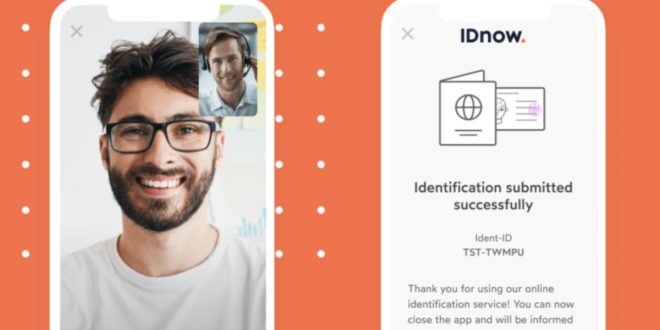

IDnow has debuted its enhanced video-led customer verification solution ‘VideoIdent Flex’ to boost customer conversion rates and accuracy of KYC compliance measures for existing partners and new clients.

A leading provider of customised ID verification solutions for high-risk sectors such as online banking, insurance, and igaming, IDnow brands VideoIdent Flex as “a bridge of AI technology merged with human interaction to achieve optimal assurance on KYC demands.”

Supporting clients with built-in AI modules to gauge biometric features, VideoIdent Flex aims to “reduce rising fraud attempts, increase inclusivity, and tackle an array of complex online verification scenarios while offering a high-end service experience to end customers.”

IDnow backs the use of live video identity verification for high-risk sectors as a critical measure to protect businesses against new real-time AI threats used by online fraudsters and money mules such as social engineering fraud, document tampering, projection, and deepfakes.

Bringing VideoIdent Flex to market, Bertrand Bouteloup, CCO of IDnow, commented: “It’s a ground-breaking advancement in identity verification, merging AI-based technology with human intuition.”

In a landscape of evolving fraud tactics and steady UK bank branch closures, our solution draws on a decade’s worth of video verification experience and fraud insights, empowering UK businesses to maintain a competitive edge by offering a white glove service for VIP onboarding.

IDnow cites that its live identity verification services have been used for over a decade by key customers in Europe, “serving the strictest requirements in highly regulated industries.”

Thus for the UK market, IDnow has re-engineered the VideoIdent Flex solution to meet the day-to-day challenges and changing regulatory demands of customer compliance and KYC measures imposed on specific UK online sectors.

Related to online gambling, IDnow highlighted the updated verification measures for “high-risk individuals; reviewing applications from high-risk persons, such as Politically Exposed Persons (PEPs), from high-risk countries; or assessing where fraud might be expected with real-time decisions, without raising suspicion.”

Bouteloup concluded: “Identity verification is incredibly nuanced; it’s as intricate as we are as human beings. This really compounds the importance of adopting a hybrid approach to identity – capitalising on the dual benefits of advanced technology when combined with human knowledge and awareness of social cues.

VideoIdent Flex is designed from the ground up for organisations that cannot depend on a one-size-fits-all approach to ensuring their customers are who they say they are. In a world where fraud is consistently increasing, our video capability paired with our experts adds a powerful layer of security, especially for those businesses and customers that require a face-to-face interaction.”