Scientific Games Corporation (SGC) has published its Q2 trading statement, underlining that COVID-19 has impacted all core business channels, as the company recorded a net operating loss of $198 million.

As previously communicated to markets, the Nasdaq technology group stated that pandemic disruptions have ‘affected comparability to previous trading periods’, as group Q2 revenues dropped from $845 million in Q2 2019 to $539 million.

Noting the severe implications of temporary closures of casino operations globally and a lower level of lottery ticket sales, SGC EBITDA bore the brunt of COVID-19 impacts, declining to $121 million, down from $335 million in Q2 2019.

The dire results, according to SGC, were ‘impacted by a $33 million Gaming segment charge related to receivables credit allowances and charges for inventory valuation’.

Meanwhile, SGC’s gaming division took the greatest hit, reporting revenues of $91 million, a 79% drop from Q2 2019’s $427 million. The group expressed hope in an uptick in gaming later in the year, with 85% of casinos having reopened as of July 23.

Despite facing global headwinds, SGC praised the performance of SciPlay and its Digital business units, which maintained growth during Q2 trading.

A breakdown of SciPlay figures saw AEBITDA increase by 80% from the prior year to $60 million, attributed to ‘increased game health driven by recently implemented game updates and features to maximize player engagement and the “stay at home” dynamic related to COVID-19’. Meanwhile Digital AEBITDA increased by 67% to $20 million.

Similar to gaming, lottery revenues also saw a 10% decline from $231 million in Q2 2019 to $209 million. AEBITDA for the vertical dropped by 6% from $103 million down to $97 million.

The group recorded a 20% increase in lottery ticket sales for instant game retail sales in the most recent four-week period compared to the same period last year.

SGC highlighted that its net cash outflow was ‘better than prior expectations of approximately $70 million to $90 million’, reporting figures of $16 million. Meanwhile net cash generated by operating activities was $52 million compared to $95 million in Q2 2019.

SGC recorded net losses of $198 million, significantly higher than the $75 million recorded in the corresponding period last year, which it again attributes to ‘lower revenue and the effects of COVID-19’.

SGC has signed-off its Q2 trading update by underlining the firm’s strong liquidity position, in which the company has secured $940 million as it executes Q2 sanctioned debt-note placements.

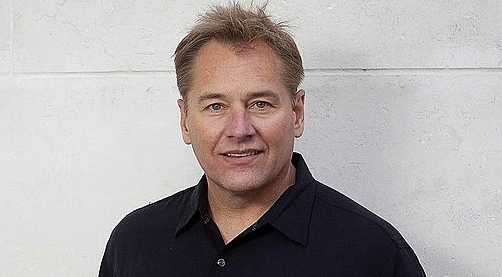

Working through an unprecedented period, Barry Cottle, President and Chief Executive Officer of Scientific Games, said: “I am very proud of how we are navigating the current environment, as evidenced by our strong cost containment and cash management, which allowed us to deliver better than expected cash flow for the quarter.

“This is a testament to our team’s ability to effectively manage our business in the short term and maintain our strong customer relationships so we are set up for success as the economy begins to reopen. The diversity of our businesses and our position on the forefront of digital gaming were critical to allow us to successfully navigate the worst of this environment.

“We have the right team coupled with the best products across both land-based and mobile gaming to position us for future growth.”