Goldman Sachs has acquired 5.4% of Kindred Group, becoming the Stockholm-listed firm’s third largest shareholder as of 31 May. The trade bodes well for Française des Jeux’s (FDJ) M&A of Kindred, but Netherlands regulatory risks are real threat to how the deal will be finalised.

While all eyes this week were on French politics, Goldman Sachs acquired a 5.4% stake in Française des Jeux acquisition target Kindred Group worth around €125m.

The trade, notified by Kindred this week, is not unusual according to investment contacts Gaming&Co spoke to as FDJ’s proposed €2.6bn bid for Kindred is still being evaluated.

One source commented that “Kindred trades very close to the deal price, which suggests the market thinks there is a high probability that the deal closes”.

FDJ’s proposal is still being evaluated by French and European authorities, the former over potential antitrust issues and the latter over whether FDJ underpaid for lottery rights at the time of its privatisation in 2019-20.

Deal Time or Dutch Derailment!

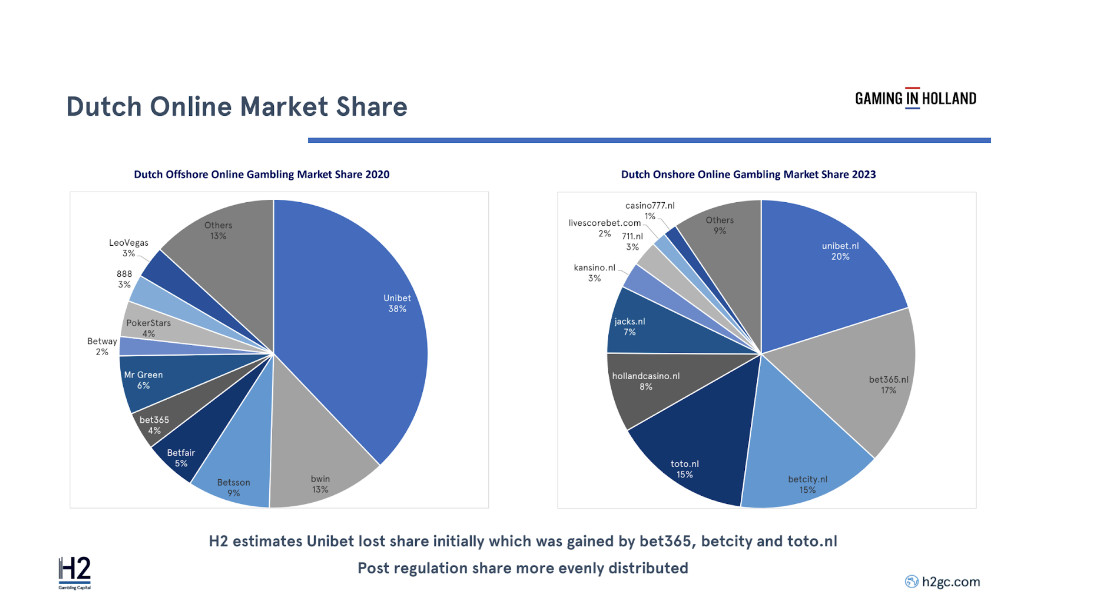

Events in Holland however may end up having more of an impact on whether the deal goes through. Kindred is market leader in the country with 20% market share, but with a potential ban on online slots being seriously considered and pushed for by some politicians, such an outcome has the potential to derail the takeover.

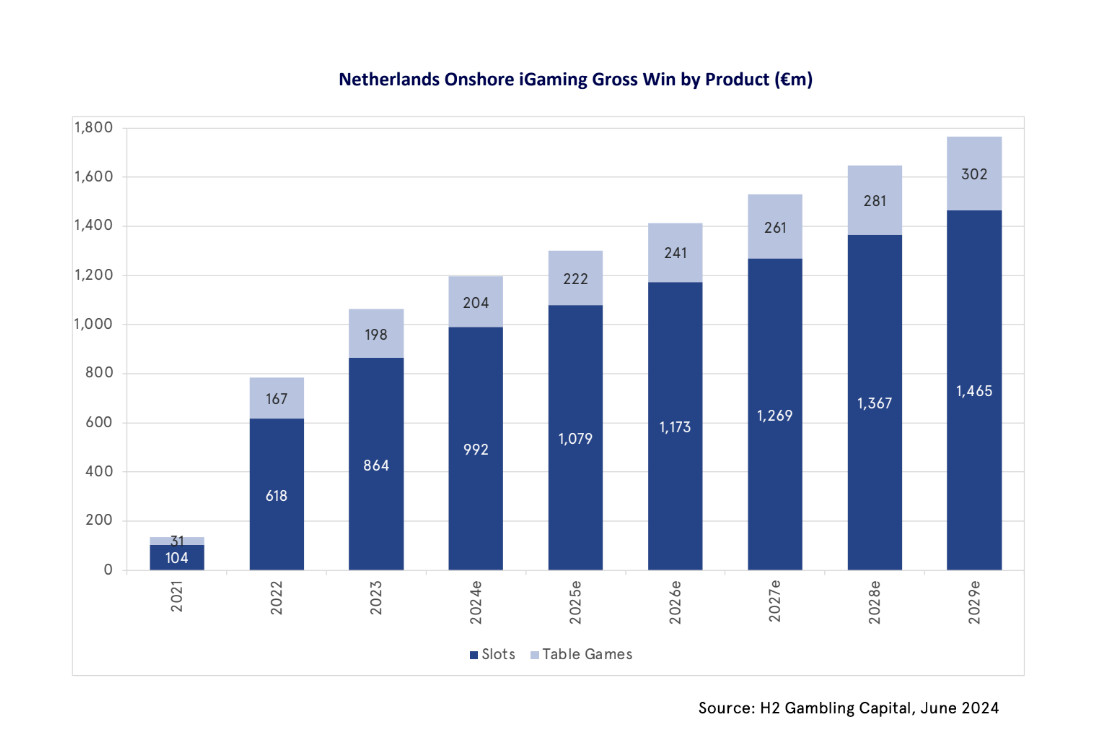

Speaking at the Gaming in Holland event last week, H2 Gambling Capital said online slots currently generate 83% of the Dutch onshore iGaming ‘KOA’ market.

“This equates to 55% of the total Dutch onshore online gambling market” and a “complete ban of onshore slot games would be catastrophic for the channelisation rates of the market” but also, potentially, for Kindred Group.

Dutch Market share moves, signal KOA dominance is at play.

While Kindred is leader with 20% market share in the Netherlands, it is closely tailed by Bet365 at 17%, and Entain’s Betcity.nl is third with 15%. The closeness of the leading trio is surprising, with many observers expecting Kindred to be closer to 30% market share.

One explanation is that by opting for the six-month cooling out period before regulation in 2021, Bet365 was operational immediately when the market opened up that year and made hay during that time.

Observers recall, that Kindred operated in the market right until regulation launched in autumn 2021, as it was forced by authorities to sit it out and only made its Dutch regulated entry in summer 2022.

____________________

Article is published by SBCNews in partnership with Gaming&Co.