In a new series, SBC Correspondent Jake Pollard dissects the intricacies of pricing European betting markets, for their unique and respective audiences.

Supported by Propus Partners, Part 1 examines French football markets priced by a diverse cast of bookmakers, competing in a marketplace where margins and market share are impacted by markets offered, pay out ratios capped at 85% and some new brands challenging well-established players.

____________________

As part of a series examining European betting markets, Propus Partners gathered data from the French market for matches in Gameweek 5 of the 2023/24 UEFA Champions League. This data has been analysed to give a high-level overview of how bookmakers within France offer Tier 1 soccer events:

-

There is a high amount of differentiation within the market on margins

-

Most recent entrant to the French market, Betsson, is the most aggressive on margin, especially on the 1X2 (match winner) market

-

Compared to many other global jurisdictions, even on core markets such as total goals, margins applied are high. We believe that this is driven by regulations

-

Some operators with in-house technology (bwin, Betclic, Parions Sport, Winamax) are those with the highest breadth of betting markets available per match

-

Only four operators offer an automated bet builder product (Betclic, Pokerstars, Unibet, Winamax)

Overround and Expected hold margin

European sportsbooks tend to use ‘overrounds‘ or ‘expected hold margin‘ as measures of margin application:

- Overrounds are calculated by summing up the ‘implied probabilities’ of all selections in a market, for example, a 1.909 vs. 1.909 market in decimal odds (-110 vs. -110 market in US odds), would have an overround of:

100 / 1.909 + 100 / 1.909 = 104.76

- The overround is a measure of how much a bookmaker would expect to take in order to expect to pay out 100

- Expected hold margin is calculated by 1 – 100 / overround. In the example:

1 – 100 / 104.76 = 0.0455 or 4.55%

Margin comparison

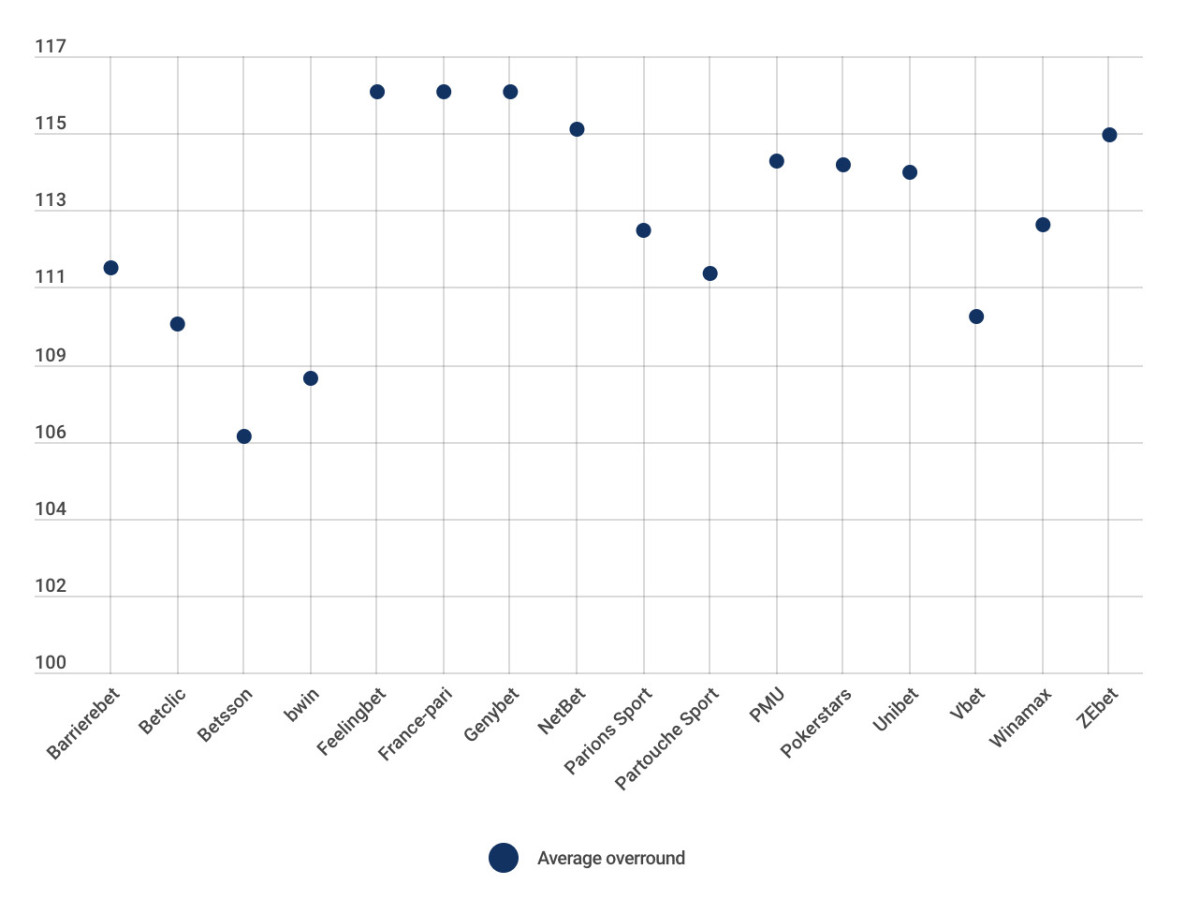

The chart below shows the average overrounds applied to match result, total goals and Asian handicap markets, for both pre-match and in-play, in this season’s UEFA Champions League gameweek 5. The data was collected within two hours of kick-off of each match.

- The most aggressive operator from this sample is Betsson, the newest entrant to the French market

- Pre-match 1X2 (match winner) markets are those with the lowest average margin applied. This is no surprise given this market is the most visible and commonly comparable

- Total goals sees a lowest pre-match overround of 106.5 from bwin, with three operators most competitive in-play, at 108.0

- Across the whole sample (all operators and market types), an average pre-match overround of 110.7 is applied, with 114.6 taken in-play

- The highest overround on any individual market is 122.0, taken by three operators on the total goals markets in-play. This is a two-selection market, where the margin taken is most visible to customers

Markets per event

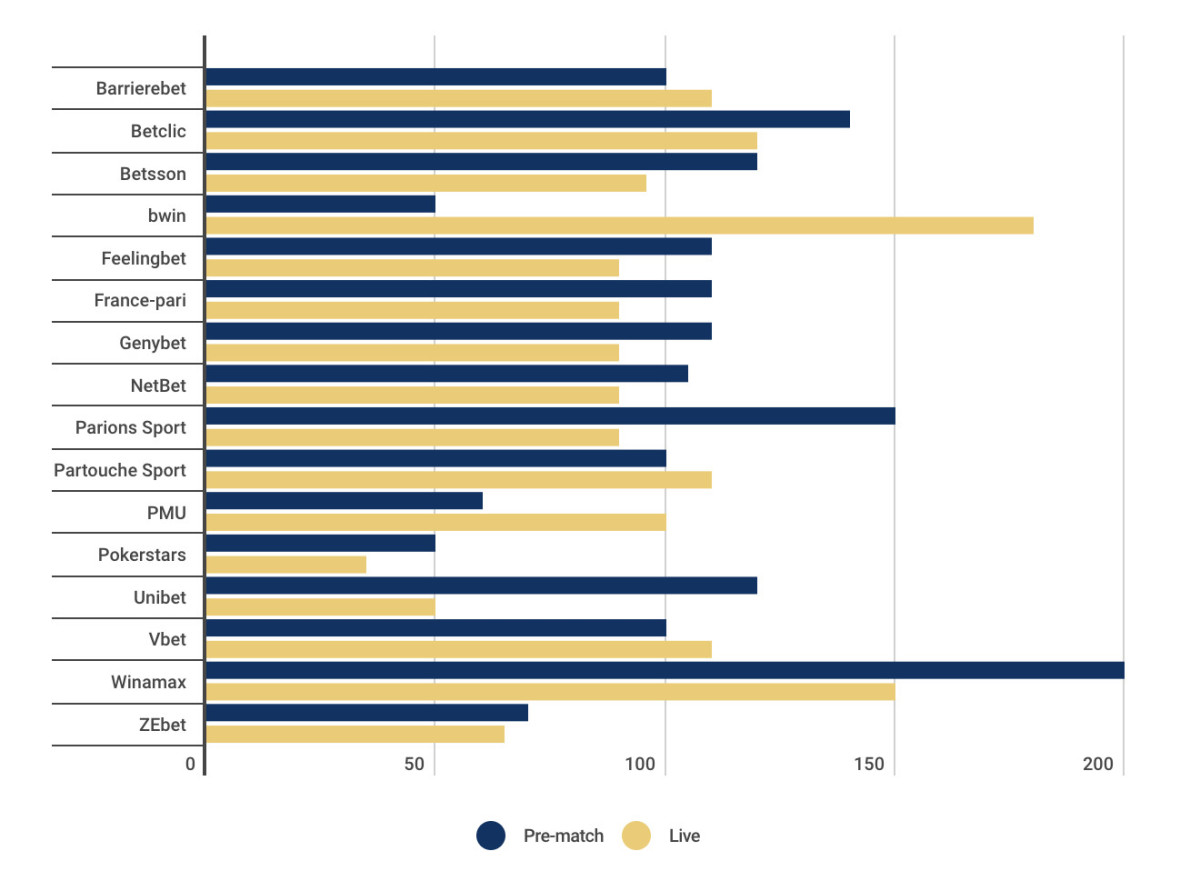

The chart below shows the average number of markets available for each event within the sample. Note, each bookmaker groups markets in different ways, so we have used a standardised approach for a fair comparison.

We don’t necessarily believe that more markets is always a good thing, the range of types of markets, their uniqueness, and how they are presented, is often more important, however it is still an interesting measure of what is being offered to customers.

- Those bookmakers driven by in-house platforms, multiple feed providers and their own trading teams (Betclic, bwin, Parions Sport, Winamax) are seem to generally be offering more markets

- Winamax is the clear leader in volume of betting markets available

- There are two platforms that supply seven of the 15 licensed French operators (Sportnco and BetConstruct) meaning that there is a lot of uniformity in market sets across the sample

Unique markets & bet builders

The French market has a number of operators that have their own technology and trade and risk teams. What this allows, in theory, is for them to differentiate as they control their own product:

- There are six operators (Betclic, Parions Sport, PMU, Pokerstars, Unibet and Winamax) offering what we see to be unique market content to their customers. This differentiation in offering is likely to aid their marketing messaging and retention

- There was only evidence of build-your-own bet builder products on four operators (Betclic, Pokerstars, Unibet, Winamax). This is comparatively low proportion within a mature European market

- While France has a relatively high number of operators using their own technology or having in-house trade/risk teams, there is still not a huge amount of real differentiation

______________________

This article is published by SBCNews in partnership with Gaming&Co.