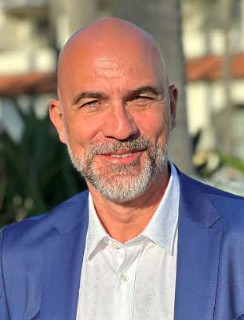

Rupert Huelsey, Co-Founder, Chief Technology Officer and Chief Operating Officer at Tally, looks at how adopting a smarter approach to marketing could pay dividends as sportsbooks cut back on lavish acquisition campaigns.

Until recently, money was no object for the biggest sportsbook operators in the US sports betting space.

Acquisition of bettors was the number one concern and the huge costs involved were not considered to be nearly as important as bringing in the numbers. In the quest to gain early market share, we saw extremely competitive investment levels into media across every market where sports betting was legalized. The US sports betting sector spent $1.8bn on ads in 2022.

Sports betting frequently took over all available media channels. Targeting was broad – either by geography (state) or context (‘anything sports’) – and investment in media as well as in bonus offers was steep. Going to look at my basketball or cycling news always ended with an intriguing bonus offer by some sportsbook.

Even in the streets, sports betting was omnipresent. Once legalized in my home city of New York, you would regularly find that every single piece of high-profile Out of Home (OOH) inventory had been bought up by major sportsbooks.

This was a very broad – as well as enormously expensive – early stage approach to marketing. Right now, with the sports betting market in the US having reached its next stage of maturity, those same sportsbooks are considering how best to forge a path towards profitability. This means adopting leaner, smarter acquisition practices, not least concerning the more precise targeting of marketing campaigns.

A New Era

There is a strong argument that sports betting is following a maturity curve similar to cell phones. In both cases, companies spent vast amounts to maximize market share and at some inflection point those enormous sums were ultimately spent in a process that saw companies cannibalizing the opposition instead of growing the market. Inevitably, that money eventually went away, with the focus instead placed on a more honed approach to marketing.

Sports betting is now, I believe, entering an era whereby it will need to start working towards tried and tested marketing methodologies.

In the case of Tally, we anticipated that point being reached – not as quickly as it actually happened, but it seemed inevitable. Taking best practice from my past venture, where I built complex data matching and modeling algorithms that were a first for targeting and measuring digital and programmatic OOH media, we knew that the sports industry would need deeper data about its fans and their interests and propensity to bet sooner rather than later. This has been further accelerated by the final sunsetting of third-party cookie-based targeting in 2024.

The work we have undertaken with a wide variety of household names in the US sports fan space has generated a big customer database. Through the deployment of engaging trivia and prediction contests we have rolled out to teams, leagues and organizations through our fan engagement platform, we not only have names and email addresses of players but also a far deeper level of behavioral information thanks to the utilization of millions of different data points.

In short, we have built a fan database that also contains detailed knowledge of what sports enthusiasts do and don’t care about. This is where the data clean room can come into its own.

A Clean Approach

Connecting proprietary data sets like those with a sportsbook’s database is key for better filtering and targeting as well as more customized, efficient bonus offers. Our data clean room opens that pathway with owned data. It is a secure way for a sportsbook to link its own database of fans, which might not necessarily contain within it any indication of a propensity to sign up, with another data set such as our own. Crucially, this takes place without either party giving up the customer lists they have worked (and paid) to acquire. The clean room works to anonymously return a new subset of people that have a strong likelihood of becoming sports bettors – far more so than was the case with the sportsbook’s own list.

In addition, it is possible to attach fandom and even betting skill to the process. Through our fan engagement platform, we can identify a set of people who are likely to be Los Angeles Rams fans, for example, meaning a sportsbook can then create customized messaging and offers to grab their interest.

While the data clean room makes sense from the perspective of a sportsbook, the process can also be applied by any media platform. If a publisher intends to create packages for sportsbooks as advertisers, it can now provide smarter targeting and even message customization as well as a rich foundation for lookalike modeling amongst the publisher’s audience. It is a compelling story to relay to an operator: in return for buying 1 million impressions on a website, the payoff is that a far higher percentage of those impressions will be delivered to people interested in sports betting, as opposed to the general population.

Appending fan and betting-specific data using clean rooms offers a smarter, more streamlined approach to marketing. As sportsbooks continue to refine their marketing spend approach, we believe that working to create better data sets on potential new customers can make a crucial difference in a highly competitive, maturing marketplace.

___________________

Rupert Huelsey – COO/CTO @ Tally Technology Group