The board of Betsson AB has disclosed this morning that it has secured definitive terms to acquire Belgium sportsbook and casino brand betFIRST in a €120m cash offer.

Deal terms have been agreed with betFIRST Group, as Betsson AB takes a podium position in the Belgium igaming marketplace.

The up-front consideration for the acquisition is set at €117m, which is to be paid in cash. An additional €3m will be paid out by Betsson as earnout incentives, should certain agreed financial targets be reached.

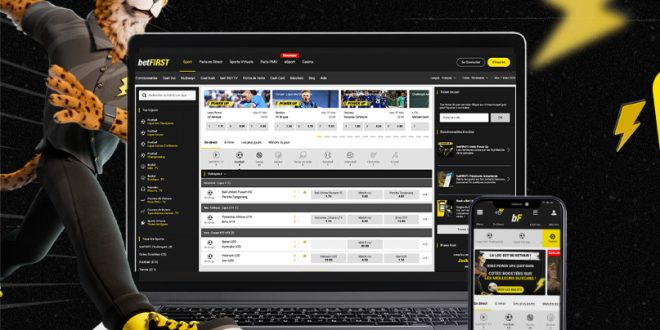

Established in 2011, betFIRST has been a leader in Belgium’s regulated online gaming market. In its last financial year ending on 31st December 2022, betFIRST reported net gaming revenue of €51m and an adjusted EBITDA of €10m.

Pontus Lindwall, CEO and President of Betsson AB, shared his enthusiasm about the strategic moves, stating: “We are very excited about entering the Belgian market together with our partners Groupe Partouche and see a strong strategic fit with the acquisition of betFIRST.

“At Betsson, our growth strategy revolves around extending our presence into new markets, particularly in locally regulated or soon-to-be regulated markets. Belgium, where the online gaming market is regulated since 2011, aligns very well with this strategy. Our business model is highly scalable, and these initiatives will add revenue and strengthen our profitability over time.”

The acquisition is set to be completed by July 5, 2023. As part of the process, Betsson has engaged Lazard as its financial advisor, and Gernandt & Danielsson, Van Bael & Bellis, and Edson Legal as its legal advisors.

In tandem with this acquisition, Betsson also announced a strategic partnership with Groupe Partouche – a leading French casino operator. The alliance aims to blend Betsson’s online gaming expertise and Groupe Partouche’s land-based casino dominance to deliver a compelling online casino product. The first joint online casino offering is scheduled for launch in Belgium in 2023, provided the necessary licenses are granted.