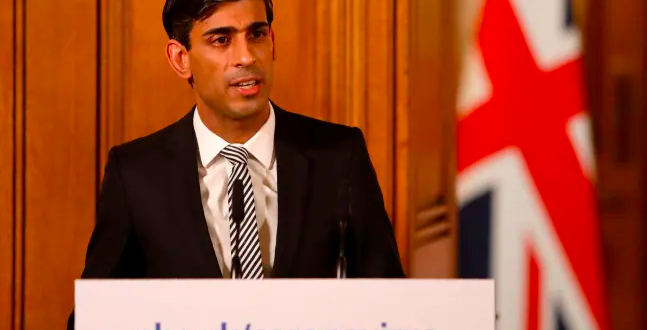

Rishi Sunak, Chancellor of the Exchequer, has declared that the UK government will take a ‘wartime approach’ to safeguard the UK economy and businesses of all sizes with a package of new measures.

Flanked by PM Boris Johnson, Sunak announced that the Treasury department had reserved £330 billion in business loans (equivalent to 15% of GDP), helping the UK economy overcome COVID-19 disruptions.

“That means any business who needs access to cash to pay their rent, the salaries, suppliers, or purchase stock, will be able to access a government-backed loan, on attractive terms,” Sunak said.

“If demand is greater than the initial £330 billion I’m making available today, I will go further and provide as much capacity as required.”

Access to the Treasury’s loan fund will be split through two main schemes supporting both the UK’s large-scale and small and medium-sized enterprises (SMEs).

The Bank of England will work directly with larger firms, establishing a new lending facility, ‘providing access to low cost and easily accessible commercial paper’.

Meanwhile, the Treasury has expanded the terms of its emergency ‘Business Interruption Loan Scheme’, expanding the programme’s loan capacity from £1.2m to £5m helping SMEs.

The chancellor states that both programmes will be up and running by the ‘start of next week’.

Fighting COVID-19 impacts, the Treasury has been granted extended powers to help individual UK sectors with funding and ‘support packages’.

“My Cabinet colleagues have urgently convened meetings over the coming days with business leaders and representatives in the most affected sectors, to identify other specific opportunities to support them and their industries, including possible regulatory forbearance,” Sunak added.

Chancellor Sunak also addressed prominent concerns attached to hospitality and leisure businesses such as pubs, clubs, theatres and further leisure/hospitality venues.

The government guarantees that all leisure and hospitality businesses will be able to make insurance claims against their policies.

Further helping leisure, hospitality and retail incumbents, the UK government stated that all businesses with a ‘rateable value of less than £51,000 will pay no rates this year’.

Noting cash-flow impacting, the Treasury said that small-sized businesses will maintain further access to emergency cash grants of £25,000 per business ‘to help bridge the period’.

Sunak said: “This means every single shop, pub, theatre, music venue, restaurant – and any other business in the retail, hospitality or leisure sector – will pay no business rates whatsoever for 12 months, and if they have a rateable value of less than £51,000, they can now get a cash grant as well.

“I also announced last week that we would be providing £3,000 cash grants to the 700,000 of our smallest businesses.”

The government’s financial pledge is undertaken amid growing concerns from numerous UK trade bodies seeking protection for businesses operating within diverse sectors, battling prominent COVID-19 downturns.

Sunak’s statement will have pleased industry trade body the Betting and Gaming Council (BGC), which this morning urged the government to intervene with an economic action plan.

The BGC had urged the government to ‘suspend consultation period’ as well as offering relief on business rates helping small enterprises.

The BGC cited emergency assistance with employment costs’ as immediate priorities to help retail and SMEs including additional time to pay on Pay As You Earn (PAYE) and National Insurance Contributions (NIC) liabilities.

In a statement to the government, the BGC detailed that UK casinos face an immediate crisis having seen customer levels plunge by 90% as ‘tourism grinds to a halt’.

Further highstreet impacts on betting shops see incumbents face a decrease of up to 60% trade on sports betting alone, following the confirmation that major sports events had been cancelled or postponed.

Michael Dugher, BGC chief executive, said: “Like all other parts of the hospitality, leisure and entertainment industries, the immediate priority for the future of our members in the casino, bingo and betting industry is the ability to pay staff.

“We urgently need temporary government support to help cover payroll costs, relief and time to pay duties and taxes, as well as access to finance. The Treasury in particular needs to step up and understand that insurance simply doesn’t cover the impact of a pandemic.”