Regulus Partners dissects the ‘mini-budget’ statement summoned by new Chancellor of the Exchequer Kwasi Kwarteng, as the closing months of 2022 will reveal the true impact of macro trends on UK gambling as consumers face a winter pinch.

For the first time in over a decade, macroeconomic issues are likely to be the dominant drivers of revenue performance in more mature markets and sectors (eg, see blog Gambling and Inflation: it was acceptable in the 80s, 18 April 2022).

In that context the ‘fiscal event’ announced by Britain’s new Chancellor of the Exchequer Kwasi Kwarteng is highly relevant for the UK gambling sector beyond the narrow relief that gambling duties were not touched. Amid considerable doom and gloom, we believe that there is cause for optimism (and we promise we aren’t contrarian just for the sake of it!)

First of all, the first half of the year is not quite what it seems in terms of online gambling decline. The major UK operators have mostly reported very difficult trading, citing tough comps, regulatory changes (both imposed and self-policed) and macro conditions. Between them. Entain, Flutter and 888-William Hill are down c. 15% YoY, with betting down a painful 26%. However, all these operators have taken a tough, proactive stance on affordability and all are more exposed to betting than the overall market. Tellingly, we have not yet seen any stats that represent the UK online market overall, so we cannot tell what is happening to share.

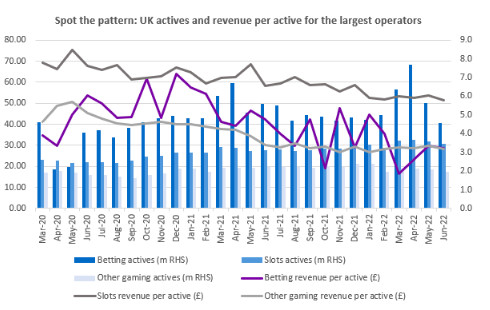

Even in betting there is some cause for underlying optimism: the Gambling Commission monthly industry stats, which are basically a mirror of the major listed operators + bet365 (and so do not capture mid-tier or long-tail, which is less relevant for betting) showed betting actives up 2.7% on H121; the number of bets per active is down 8%, but that can be entirely explained by a normalising betting calendar post Covid-19 policy disruption. The cause of the remaining 18% betting revenue decline is objectively easy to pinpoint: a c. 30% reduction in stake per bet.

While March was a particularly tough month, GGY per bet during Q2 was running 34% below the historical average. The reason for this is not sports margins and the data is not repeated in gaming stats (see below), so something specific was happening to the betting customers of the larger UK operators. There is a logic for seeing betting as being impacted earlier in a consumer economic cycle than gaming: it is much more mass market and therefore likely to be more discretionary. However, the betting GGY per active trend has been noticeable since January 2021, materially before macro conditions became a material driver. We believe that there a three main causes for this:

- major changes to affordability checks for the major operators, which has reduced overall revenue and impacted market share

- a shift in market share to second-tier and black market operators, especially among higher value bettors, as the major operators shift focus to the mass market; NB, this will not be picked up in the more recently published industry stats except as a hole

- more aggressive promotional activity, which has encouraged actives (on a seasonally adjusted basis) but reduced revenue as the bonuses are played through

However, with the introduction of stringent affordability measures now being lapped, comparable remote betting revenue entering a period of easy comps, and bonusing activity normalising, we would expect an increase in betting GGY from current levels. The fact that people know that their energy bills will not increase further this year, that their taxes will be lowered from next year and that employment remains strong is also likely to be a factor in overall betting resilience. Further, while some industry observers and participants view a Q4 World Cup (Nov-Dec) occurring in the UK morning – afternoon with trepidation, we believe that there is considerable potential upside from this timing quirk.

While hosting the World Cup in the Summer extends the trading period into a normally quiet time for soccer, the Qatar World Cup provides additional rich content that occurs all in one quarter while everybody is engaged and likely to be indulging in a lot of ‘working from home’. Further, the experience of 2021 demonstrates that a compressed calendar is more conducive to stimulating betting volumes than an extended one. While gross margins remain a lottery, we expect actives and betting volumes to be record-breaking for the UK. By comparison, Q421 betting GGY was 40% below the last three quarters. The likelihood of a strong Q4 mass market betting bounce-back that is sustained into 2023 is quite high, in our view.

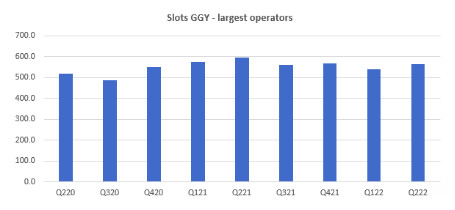

Gaming has so far proved far more resilient than betting, with ‘other gaming’ feeling the pain of a normalising poker product and likely some affordability headwinds. However, it is telling that the ‘Big Three’ betting-led operators, along with Bally, Rank and Playtech (Sun B2C) have all reported H121 gaming results that are resilient against very tough comps (excluding poker): the big three -4%; Bally -7%; Rank +1%; Sun +3%. Slots revenue in particular for the largest operators has held up well when factoring in the timing of retail reopening and the developing energy crisis:

This is not a chart which shows any discernible macro impact, especially when affordability-related market share shifts are factored in. Gaming revenue is more concentrated into fewer people than betting, it is therefore more likely to be late cycle. But since gaming is more VIP-driven it is also likely to be more sensitive to fiscal stimulus at the top end of consumer discretionary and to business owners than broader policies. Here, the scrapping of the 45% income tax rate from April 2023 and the help the new government wants to give to small businesses during the energy crisis could be significant to seeing a path for growth.

The UK is overwhelmingly a consumer economy, with consumer spending worth c. 60% of GDP. The new government’s fiscal approach is clearly designed to protect and stimulate this spending rather than suppressing it in favour of asset inflation, which has broadly been international government policy since 2008.

There is no doubt that consumers started to feel the pinch during Q3, for which we do not yet have data, but there is little evidence that they were adjusting their behaviour materially because of macro trends before that. Consequently, as gambling-specific drivers for depressed online revenue in H121 unwind and the new government focusses on consumer-led economic growth, we believe that the likelihood of the UK online sector staging a muted but meaningful economic recovery has been considerably increased.

Whether or not this applies to retail gambling is a rather different matter, however, as high-street footfall, the use of cash and the cost of rental property all remain dangerous uncertainties with little cause for hope. Rapid economic change and higher interest rates are likely to further encourage real-terms channel shift and wipe out the last vestiges of ‘transactional’ retail gambling, in our view: the long-promised omnichannel, entertainment- and community-led landbased experience of the ‘future’ should become a very urgent priority for survival.

____________________

Featured article edited by SBC from ‘Winning Post’ Sunday 25 September 2022 (click on the below logo to access the full unedited analysis of Winning Post).