India’s 53rd Goods and Services Tax (GST) Council meeting produced all but good news for the igaming sector in the country.

During the hearing hosted by Nirmala Sitharaman, no hints whatsoever were given as to whether the 28% GST levy, currently imposed on the full value of bets made on online games, will be subjected to re-evaluation.

PM Modi’s cabinet first introduced the nation-wide tax hike back in October 2023, when it increased the previous GST levy of 18% to 28%.

Officially enforced in Kerala on 5 January by regional state governor Arif Mohammed Khan, the new tax has been gradually incorporated throughout the rest of India’s biggest economic centres, troubling the local gambling industry ever since.

The 28% GST tax is being slapped on every player deposit made to all online gaming providers, regardless whether it’s horse racing or casino that is on offer.

Previous efforts by the private sector to turn the tide in its favour by proposing the 28% GST levy to tax gross gaming revenue (GGR) instead of deposits have fallen on deaf ears.

The changes have forced some major operators like NYSE-listed Superbet, the parent company of Betway, to hastily exit the market, while others like FTSE100 Flutter Entertainment – which operates the Indian online Rummy room Junglee – are carefully considering what steps to take next.

Even Google has felt the effects of the tax levy, with the tech giant jostled into revising its Play Store real-money games (RMG) policies announced at the start of the year – just hours after the GST Council meeting concluded this Saturday, 22 June.

Industry takes the blow

The GST tax slab hike has inevitably led to the issuing of significant tax evasion notices to online gaming companies – some spanning all the way back to 2017 – which in turn has led to a cluster of complaints filed with India’s Supreme Court over unjust repercussions.

International and local businesses such Indian casino and igaming provider Delta Corp have put forward their concerns that the revised GST levy and the subsequent tax evasion notices are straining their operations, leading to mass layoffs and forced corporate restructuring.

During last weekend’s GST Council meeting, Sitharaman welcomed a proposal to waive all interest and penalties on the demand notices issued between FY 2017-2020 under Section 73 of the GST Act.

However, the items under this section do not include cases that involve fraud, suppression of financial accounts or misstatements – a key element of the tax evasion notices handed out to igaming firms.

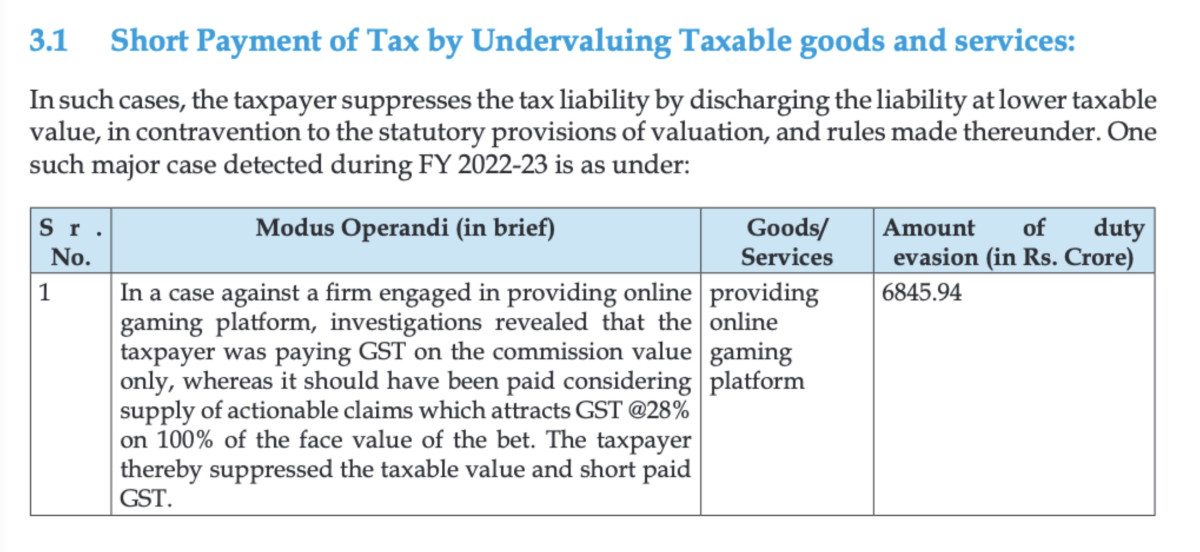

In fact, according to the Directorate General of Goods and Services Tax Intelligence (DGGI) of India, online gaming providers had the highest amount of “duty evasion” for FY 2022-23, standing at Rs 6.845 Crore (around £647m).

But the fact that the Indian igaming sector is hurting remains. A report by Ernst & Young (EY) and the US-India Strategic Partnership Forum (USISPF) has brought the numbers into light.

The new GST levy has been painted as either “detrimental” or “catastrophic” to companies’ revenue, with most of the surveyed businesses finding it difficult to stay afloat in the current tax landscape.

Branding it as a “funding winter”, EY and USISPF noted that no capital has been raised in the gaming sector since the onset of the new regime in October 2023. Compare this to the $2.6bn raised form domestic and global investors in 2019, and the picture becomes more harrowing.

According to the study, GST taxation now consumes between 50% and 100% of the revenue for 33% of companies, even surpassing the total revenue generated by startups – making it a swim against the current.

Additionally, more than half of the surveyed sector’s enterprises are now facing stagnant revenues and shrinking topline, with 25% recording growth declines of up to 50%.

“This marks a stark departure from previous growth rates exceeding 100-200%,” EY and USISPF wrote.

The revenue erosion has been felt mostly across job prospects in the sector, with most companies being forced to cease hiring, initiate layoffs or shut down altogether.

“For a sector which has created 100,000 jobs and was expected to create around three times more jobs in the coming years, such job erosion is an alarming concern that reflects the adverse business impact of the GST amendment,” the report highlighted.

What next

With the budget for the next four years coming in hot this July, and a review on the GST tax constantly falling out of sight – it might look as if the fate of igaming operators in India is sealed for the foreseeable future.

However, experts still remain optimistic about the prospects of the sector, which could be turned around if the Indian government sets a clear distinction between games of skill and games of chance for taxation purposes.

Dr. Mukesh Aghi, President & CEO of USISPF, concluded: “In aligning with global practices, India should clearly distinguish between games of skill and games of chance for online gaming taxation and regulation.

“India can benefit from this approach by bringing in new-age technologies and investments from across the world. Our study indicates that the impact is concentrated in real-time games limited to fewer players where the business model is still evolving.

“The gaming sector needs support to grow and bring out the best possible efficiencies.”