Tim Miller reflected on the journey and the scale of work undertaken on the UK Gambling Act review and its subsequent White Paper consultations as the most comprehensive examination of a gambling market undertaken by a regulatory agency. Many believe that the process of the Gambling Review had been triggered before the Department for Digital, Culture, Media and Sport (DCMS) …

Read More »Tag Archives: Monzo

Banks’ gambling blocking tools on the rise as costs of living bites budgets

Prominent banking and financial services firms have noted an increase in the use of gambling blocking software, as consumers try to curb their spending. In the face of rising costs of living throughout the winter, coupled with the usual monetary pressures of the Christmas period, Monzo is one provider which has seen an upsurge in usage. The open banking company …

Read More »GambleAware publishes report and guide for financial services to help prevent gambling harm

GambleAware has published a new report analysing behavioural datasets, in order to understand if this method could be used to build a more precise picture of how people gamble, identify signs of harm, and eventually inform prevention, treatment, and support responses. Conducted by the charity’s Behavioural Insights Team, the new research examined bank transactional data from Monzo and HSBC to …

Read More »GamCare calls on collaboration to fill gambling block inefficiencies

GamCare has called for UK financial institutions and businesses to work together in ensuring that all ‘gambling block’ loopholes are closed in order to protect vulnerable consumers. The call for collaboration follows GamCare hosting its ‘Gambling Related Financial Harm’ workshop in which diverse financial stakeholders shared insights on the design and safety features of gambling block tools used by banking …

Read More »UKGC issues full public guidance on gambling block services

The UK Gambling Commission (UKGC) has launched its new consumer guidance campaign, providing the general public with a full breakdown of the ‘gambling block services’ currently offered by highstreet and digital banks. The campaign forms part of the UKGC’s new ‘money and rights’ section launched at the start of the year, providing the public with detailed information with regards to …

Read More »Monzo trials ‘universal gambling block’ with TrueLayer open banking systems

Digital bank Monzo has partnered with compliance and open banking software provider TrueLayer to develop an ‘industry-wide universal gambling block’ solution for the financial services sector. The Fintech incumbents revealed that they are trialling an ‘open-banking API’ to develop a comprehensive gambling block solution, impeding transactions between financial service providers (banks, credit cards, e-wallets, loans, etc) and gambling businesses. In …

Read More »Monzo CEO calls for universal gambling self-exclusion

TS Anil, the new chief executive of digital bank Monzo, has published an open letter to the UK government calling for the increased enforcement of responsible gambling safeguards on UK licensed operators and financial services providers. The statement comes as social responsibility and customer affordability take on heightened importance, with UK gambling faces imminent changes as the government undertakes its …

Read More »GamCare backs #TalkMoney campaign to broaden public financial advice

GamCare has shown its support for the Money & Pensions Services (MaPS) annual ‘Talk Money Week’ (#TalkMoney) national campaign, which encouraged the general public to openly speak about their personal finances. Hosted from 9-13 November, the #TalkMoney campaign placed financial concerns related to problem gambling as a key topic, as the public finance body encouraged the public to seek open …

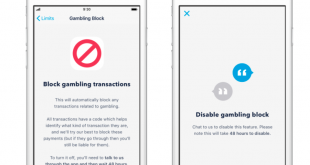

Read More »NatWest adds a 48-hour cooling-off period to gambling block feature

NatWest has introduced a gambling block on debit cards, giving customers the option to trigger a 48-hour cooling-off period via their mobile banking app. Any transactions attempted during that time frame will be automatically declined, with the block remaining in place indefinitely unless a customer chooses to remove it, in which case it can be disabled after the 48-hour period. …

Read More »223,000 customers activate Monzo gambling block

Digital bank Monzo has revealed that 223,000 of its customers have activated its gambling block feature, with the number of users having more than doubled in the past year. Reported on AltFi, the digital bank confirmed that approximately 5% of its total customer base had activated the gambling block feature which allows users to stop transactions to bookmakers, both in-person …

Read More »