GamCare has called for UK financial institutions and businesses to work together in ensuring that all ‘gambling block’ loopholes are closed in order to protect vulnerable consumers.

The call for collaboration follows GamCare hosting its ‘Gambling Related Financial Harm’ workshop in which diverse financial stakeholders shared insights on the design and safety features of gambling block tools used by banking services.

The workshop featured input from 45 representative working across the financial services of banking, current accounts, payment systems debt services, compliance, security and customer verification.

The group was supported by the feedback from victims with lived experience of gambling harms providing insights on how gambling blocks can be bypassed.

Raminta Diliso, Financial Harm Manager at GamCare, said: “We’re pleased that so many organisations have shown interest in this issue and we would like to see a collaborative cross-sector response to drive through a number of additional changes to further protect people from gambling-related harm”

“Year on year, around 70% of callers to our National Gambling Helpline mention some level of gambling debt and financial hardship. For those trying to stop gambling, banking blocks offer an invaluable layer of protection, but people that use our services have reported that they have managed to circumvent the blocks.”

The workshop identified a number of ways in which gamblers who have excluded themselves from making payments to gambling operators can still deposit with operators.

Concerns were raised on the increase of ‘non-card transactions’ offered by gambling operators through e-wallets and open banking modules to process faster payments.

Financial experts noted of the multiple ways in which to make transactions not carry the appropriate merchant category code, resulting in less visibility for banking providers.

Misclassifying merchant codes is a common abuse used by unlicensed operators to disguise transactions as non-gambling transactions, which bypasses gambling blocks on debit and credit cards.

The workshop concluded recommending that e-wallets introduce gambling blocks to protect vulnerable gamblers and improve consumer safety.

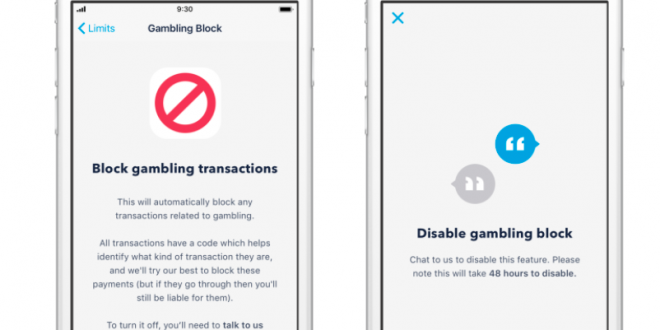

Workshop stakeholder Natalie Ledward, Head of Vulnerable Customers at Monzo, said: “Monzo was the first bank in the UK to launch a gambling block. Since then more than 300,000 of our customers have used it, with less than 10% turning it off.

“With more and more gambling companies offering new ways to pay, we’re working to make sure our gambling block covers all of these new payment options. This year, we piloted an extension block with TrueLayer, to help extend our block to cover Open Banking payments.”