STS Group reaffirmed its market leadership position in Poland with the publication of its H1 trading results as the company narrowed its focus to its home market.

The betting and gaming group, trading on the Warsaw Stock Exchange, reported an increase in net gaming revenue of 17% from PLN 296m (€64.5m) to PLN 346m (€75) driving subsequent growth in terms of both revenue and profit.

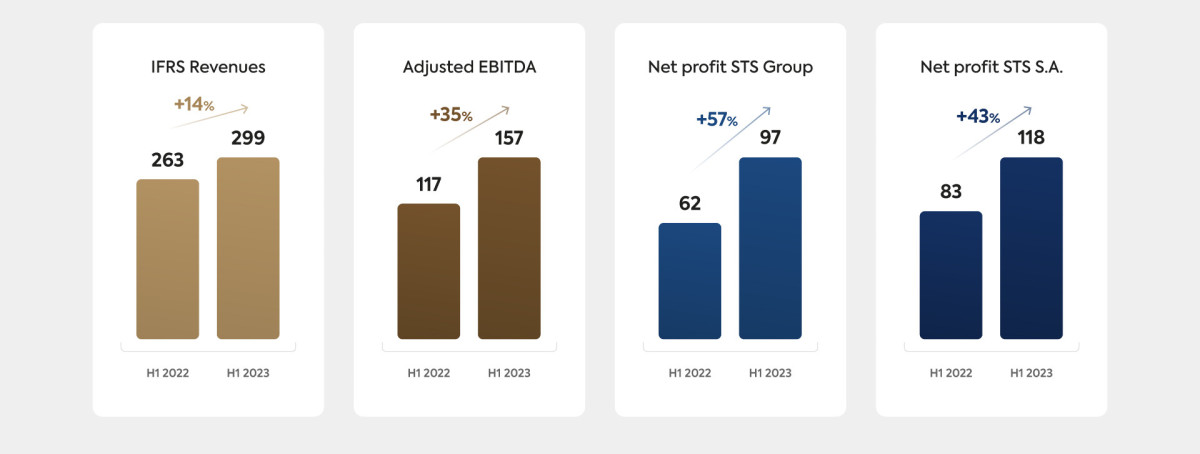

Group-wide revenue stood at PLN 299m (€65m), up 14% on corresponding H1 2022 results of PLN 263m (€57m). Meanwhile, net profit rose 57% from PLN 62m (€13.5m) to PLN 97m (€21m), and adjusted EBITDA by 35% from PLN 117m (€25.5m) to PLN 157m (€34m).

Further H2 figures saw the bet value of STS Group clients amount to PLN 2.3bn (€502m), an increase of 5% from PLN 2.2bn (€477m) the year prior, whilst the group closed H1 with 412,000 active users of which 109,000 were new registrants and 72,000 were first time depositors.

H1 was a period of major business development for STS Group, with the firm firstly setting out to focus its operations on the Polish market, seeing an end to its overseas activities in the UK and Estonia.

STS’ objective in this area is to ‘exploit, to the fullest extent possible, the potential of the Polish market’, where as stated above the firm has established its position as the clear market leader.

Figures released in November last year showed that STS is miles ahead of its nearest competitors, Fortuna Entertainment Group and Betfan, in terms of revenue. At the time, the group’s revenue led Fortuna – the second largest in the market – by PLN 121m (€27m).

Commenting on H1 2023, Mateusz Juroszek, President of the Management Board of STS Holdings, said: “In the second quarter of this year, we continued to optimise processes within the STS Group. Therefore, in H1 of the year we significantly improved both the financial result and the adjusted EBITDA, which increased by 57% and 35% year on year, respectively.

“We assume that in the second half of the year the activity of our players will be higher, which should have a positive impact on our operational and financial indicators.”

The announcement of STS’ financial results for the first six months of the year comes ahead of a transformative moment for the company as it prepares for integration within the Entain portfolio of brands.

Entain’s CEE – the FTSE100 group’s Central and Eastern Europe (CEE) venture – purchased 100% of the shares of STS on 7 July 2023 for a sum of £600m.

The move further strengthens Entain’s ambitions in the CEE region, where it already owns Croatian market leader SuperSport. It can also be expected that STS will gain support from the group’s extensive financial capital, in-house technology and responsible wagering services.

At the time of the acquisition’s announcement, Juroszek said: “We could not have found a better partner to help us take STS into the next phase of its growth, and it is clear that Entain shares our ambition and vision for its future. I look forward to continuing to lead and grow STS, and to working in close collaboration with the Entain CEE team.”