Completing its first year as FTSE100 enterprise, GVC Holdings reports that the betting group has demonstrated its global scale and market diversification capacities, delivering growth across all operating territories.

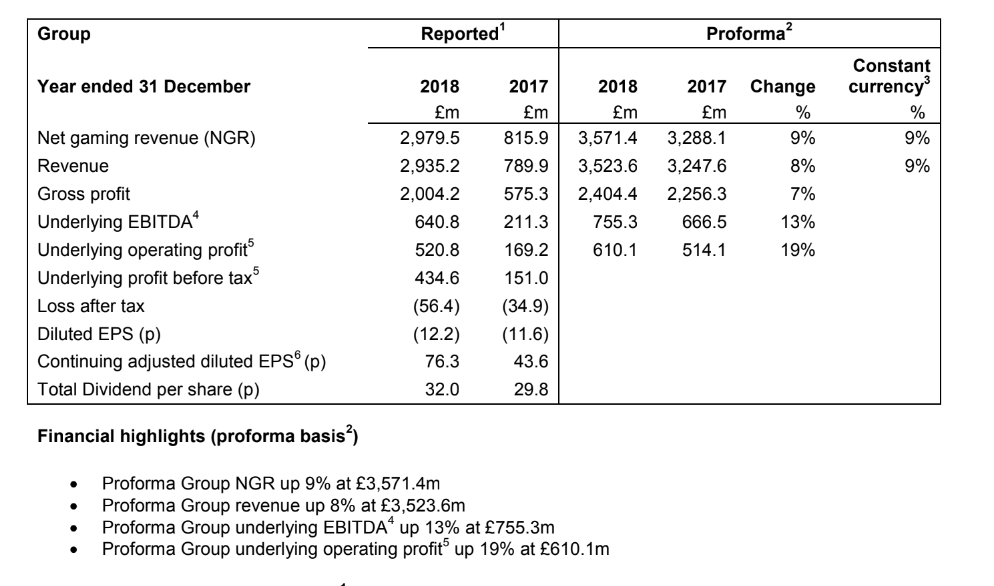

The firm’s enlarged portfolio of nineteen brands, operating across multiple European jurisdictions records full-year 2018 group revenues of £2.9 billion (FY2017: £800m) – as GVC governance continues to explore further new market opportunities.

“2018 was a transformational year for the group with the completion of the Ladbrokes Coral acquisition in March making the group the largest online-led sports-betting and gaming operator in the world,” Kenneth Alexander, Chief Executive of GVC Holdings, details to investors.

Highlighting its ‘digital capacity’, GVC records online revenues of £1.3 billion, supported by an underlying EBITDA growth of £443 million (FY2017: £238m), with the FTSE firm’s enlarged sports betting portfolio contributing an NGR £725 million (FY2017: £292m), with all brands benefiting from World Cup 2018 trading.

Despite its digital growth, GVC replicates tough UK trends across it newly integrated retail vertical (Ladbrokes Coral) with the company reporting a pro-forma 8% decline in OTC wagering to £3 billion (FY2017: £3.3 billion).

Despite reducing retail operating costs to £529 million following the UK government’s FOBTs judgement, GVC’s new division would record declines across all metrics, reporting an underlying EBITDA of £193 million (proforma-FY2017: £265m).

Closing 2018 accounts, GVC reports an underlying group EBITDA of £640 million (FY2017: £211m), as the enlarged operator books in exceptional charges totalling £435 million, resulting in GVC governance reporting a loss after tax of -£56 million.

Moving forward, GVC details that it will continue to apply its ‘four strategic enablers’ of leading the global gambling market in technology development, digital product propositions, brand and marketing engagement and staff management.

Alexander added: “The GVC operating model leverages the Group’s leading proprietary technology and product development capability, applying central marketing expertise alongside local operational execution. This model is proving highly effective.

“Combined with the benefit of being a truly global scale operator, together with the opportunities provided by the integration of Ladbrokes Coral and our joint-venture in the US with MGM Resorts, the Board is confident the Group is well-placed to absorb the impact of the Triennial Review and associated tax increases in 2019, and deliver strong EBITDA growth in future years.”

GVC Holdings 2018 Performance Overview