HMRC has accepted a policy proposal that will expand the tax bands on gross gaming yield (GGY) applied to land-based casino earnings.

New tax bands will be applied from 1 April 2022, as HMRC aims to maintain casino operator duties at real levels of inflation.

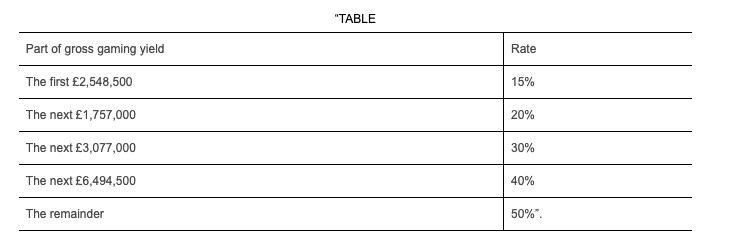

Applied since 1997 and last amended during 2021, HMRC currently applies a staggered 15-to-50% tax banding on casino GGY between £2.5 to £13.8 million.

The revision applied to the upcoming 2021/2022 Finance Bill, will see casino GGY bands applied at 15% for up to the first £2.6 million, and capped at 50% above £14.6 million.

“The measure will ensure that the gaming duty accounted for by the casino operators is maintained at real levels.” the proposal stated. – “If the bandings were not increased in line with inflation, then over time more GGY would be subject to higher rates.”

In its summary, HMRC underlined that the revised tax bandings would have no effect on the Exchequer’s tax estimates and no significant economic impact.

The measure should also have no impact on casino price and pay-outs for consumers.

The revised tax bandings are expected to have a negligible impact on the UK’s 50 licensed casino operators – however, HMRC underlined that the revision should be looked upon as ‘routine uprating expected by the industry’.

UK Casino GGY Tax Bands 2021